- Learn how to save hundreds in taxes by utilizing your Isa and pension allowance

- Why tax aid may help enhance your portfolio efficiency

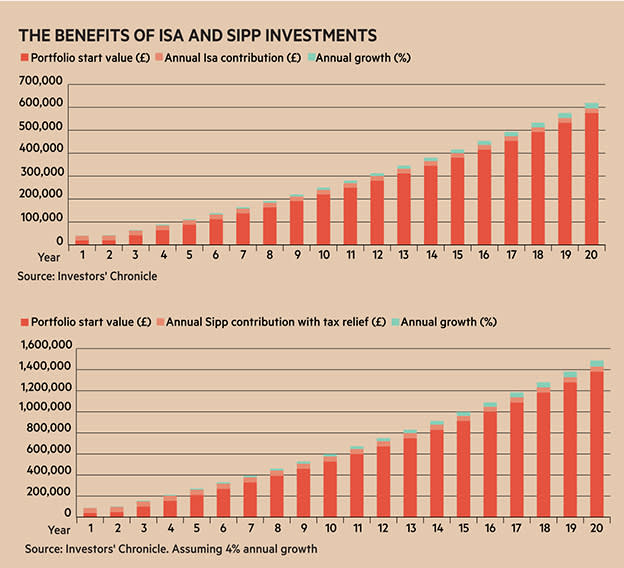

There’s one reply to funding’s greatest tax query: ought to I exploit a Sipp or an Isa? Each. Benefiting from the total allowance means most individuals can shelter a most of £60,000 of annual financial savings from capital beneficial properties and revenue tax (£20,000 in your Isa and as much as £40,000 in your Sipp). The cash in your Sipp additionally enjoys tax aid on the fee you pay revenue tax – for now.

And once you make investments that cash within the inventory market, the advantages shortly mount up. An investor who makes use of their full Sipp and Isa allowance can save many hundreds of kilos in tax payments through the years in contrast with one saving the identical quantity outdoors of the tax wrappers

As capital beneficial properties tax is just paid on crystallised beneficial properties, it may be tempting to depart your cash available in the market. However this solely delays the difficulty. As Mary McDougall highlights in our complete overview of the Isa tax wrapper, if you happen to invested £20,000 yearly, a inventory market rising persistently at 4 per cent would carry your portfolio over the £1m mark after 28 years. But when that cash was sitting outdoors an Isa, nearly half of it could be taxable.

And sheltering your cash from the tax man is just the beginning of the benefits. The ability of compounding implies that these tax financial savings will have an effect in your portfolio development.

And even for these not blessed with the chance to max out their allowance yearly, the Sipp versus Isa query has the identical reply – take advantage of each allowances. However which to prioritise? The reply to that differs relying in your private circumstance and your stage of life. Understanding the fundamentals may help you make the fitting choice.

When to tax and when to spend?

The primary tax advantages from the Isa and Sipp come at totally different instances. Your Sipp financial savings are tax free on the level of funding as a result of the cash added to a Sipp receives tax aid on the fee you pay revenue tax. Which means the after-tax price of a fee right into a Sipp is way decrease than it’s for an Isa and that may have a big effect on returns.

For instance, an investor who generates 4 per cent development from an £800 annual funding of their Isa yearly for 20 years will likely be left with a portfolio price £25,575. The identical funding in a Sipp by a basic-rate taxpayer could have tax added again, which means £1,000 is invested yearly. After 20 years the portfolio could be price £31,969.

The Isa wrapper comes into its personal once you wish to spend the cash you’ve gotten invested. The entire cash is freed from capital beneficial properties and revenue tax and there are not any restrictions on when this may be taken, until it is in a Lifetime Isa. In contrast, solely 25 per cent of the cash in a Sipp will be taken as a tax-free lump sum (though as revenue drawn down thereafter is taxed in the identical method as a wage, you would possibly have the ability to obtain some revenue tax free) and it’s only accessible from the age of 55 (it will rise to 57 in 2028 and improve in keeping with the nationwide retirement age).

For brand new or younger traders, the temptation subsequently is perhaps to take advantage of your annual Isa allowance yearly and never fear concerning the Sipp – in spite of everything, retirement is a great distance off. However the sooner you make investments, the extra tax you’re going to get again from HMRC, leaving compounding to do its job in your financial savings.

Perceive your allowances

The Isa allowance is ready at a hard and fast degree yearly (at present £20,000) and can’t be rolled over. Your annual pension allowance is tied to your revenue (you’ll be able to pay 100 per cent of your annual earnings into your Sipp as much as a most of £40,000) and contributions to a office pension will use a few of this up. Which means you is perhaps higher off benefiting from your office pension if the supply is beneficiant sufficient.

The pension financial savings you make by your office scheme take pleasure in the identical tax aid as these in a Sipp and your employer is obligated to pay a minimal of three per cent of your wage on prime of your contribution (most no less than match your contribution). For that reason, it’s all the time finest to save lots of as a lot as you’ll be able to in a beneficiant office scheme and use your Isa allowance for additional financial savings.

Nevertheless, if you happen to aren’t utilizing your full pension allowance by your office scheme, it’s definitely price topping it up with a Sipp. It is usually price being attentive to the pension supplier utilized by your office. For instance, in case you are a great distance from retirement and subsequently capable of take barely extra threat along with your financial savings, you might be higher off utilizing extra of your annual allowance in your Sipp and investing it in funds or corporations which are going to make the perfect use of your capital.

The identical is true of outlined profit pension schemes which assure you an revenue once you retire primarily based in your wage when you have been at work. At present, it’s greater than doubtless that this will likely be primarily based in your profession common earnings, slightly than your ultimate wage (this terribly beneficiant pension scheme is being wound down throughout a lot of the public sector). It might be price contemplating constructing on this assured pot with a Sipp.

Begin early to get the perfect of each accounts

Prioritising your Isa and your Sipp is a private choice that may rely on what you intend to make use of your financial savings for. As a basic rule of thumb, any cash earmarked for a sure goal previous to your retirement needs to be saved in an Isa, different investments ought to go into your Sipp.

However selecting the correct account issues lower than saving early and sometimes. So don’t delay – arrange an Isa and a Sipp to take advantage of your annual allowance for 2020/21.