One of the fashionable choices to make an funding aimed toward saving tax on earnings is investing in mutual funds which qualifies for deductions below Part 80C.

New Delhi | Abhinav Gupta: The monetary 12 months is nearing its finish and that is the time when the salaried class and buyers begin making investments to be able to save on earnings taxes. One of the fashionable choices to do this is investing in mutual funds which qualifies for deductions below Part 80C.

Nevertheless, what creates a hurdle in going forward with the fruitful possibility for many people is the lack of expertise in regards to the mutual funds and the right way to spend money on them to realize most advantages.

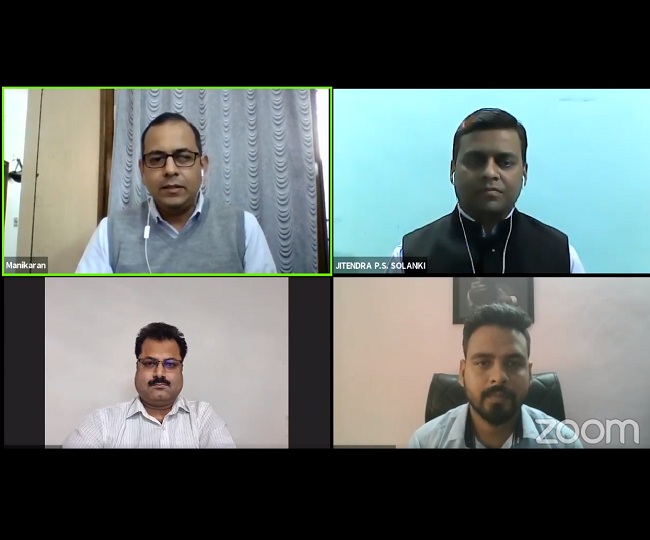

Holding in thoughts the view of informing our readers and assist them make the fitting resolution on investing in mutual funds, Jagran New Media’s Manish Mishra and Abhinav Gupta held an in-depth dialogue with SEBI-registered funding advisors Jitendra Solanki and Manikaran Singal below Jagran Dialogues.

Right here the excerpts of the panel dialogue with the funding consultants:

Q.What are mutual funds? How can we spend money on them and why?

Manikaran Singal: Mutual funds are a means by which you’ll be able to spend money on totally different funding asset courses. There are solely 4 methods on investing – fairness, debt, gold and actual property – and after we don’t make investments immediately in them and moderately go for knowledgeable administration service, then the choice of mutual funds comes up.

Mutual fund is a pool the place small buyers convey their cash collectively in keeping with the target of the fund and the objective of the fund supervisor after which the target determined by that fund home is dealt with by the skilled administration which diversifies the funds to fulfill the objective.

So mainly, the place you aren’t immediately geared up to make an funding by yourself, the place you want an knowledgeable’s help so as to add up your cash step by step, mutual fund could be a useful product there.

Q. Why go for mutual funds after we can spend money on FD, NSC? How can they be helpful for us?

Jitendra Solanki: Mutual funds include a variety of asset class choices like fairness and debt and the latter additional comes with a number of selections. After we speak about conventional deposit like FD, there are two main components taken into consideration – first is taxability, i.e. the tax legal responsibility on the incomes created from the funding and second is inflation – that are tough to beat.

So, after we plan a long run funding, we want choices the place we will let go these components and this selection is on the market with mutual funds, specifically for a small investor who desires to begin investing with an quantity as low Rs 500 or Rs 1,000.

Watch the whole panel dialogue right here:

[embedded content]

Posted By:

Abhinav Gupta

Let’s block adverts! (Why?)