“Investing ought to be extra like watching paint dry or watching grass develop. If you’d like pleasure, take $800 and go to Las Vegas.” — Paul Samuelson

On Tuesday, Japan’s Nikkei 225 index crossed 33,000 for the primary time since 1990. We determined to take a look at Japan’s inventory market to see what’s driving the outperformance towards different international benchmarks and whether or not it’s sustainable.

The Nikkei 225 index is now up about 30% year-to-date in comparison with the S&P 500 and MSCI world indexes that are up 14% and 12% respectively. That 30% achieve is a bit deceptive because the Nikkei is priced in Yen, however even priced in USD it’s up 20% for the yr.

Regardless of the sturdy efficiency, Japan’s index remains to be 14% beneath its 1989 peak of 38,957. So why is Japan performing so strongly now, and what induced this decade’s lengthy stoop?

The Misplaced Decade(s): Japan’s Deflationary Hunch

From 1960 to 1989 Japan’s economic system and inventory market skilled a golden interval. Native consumption and rising exports (assume Sony and Toyota ) helped to determine the nation because the world’s second largest economic system. Through the Nineteen Eighties alone the benchmark inventory index rose 500% as Japan grew to become the funding vacation spot of alternative.

As is usually the case, the increase was a bubble which burst in 1989 when the central financial institution raised charges to discourage hypothesis in the true property and inventory markets. The deflating asset bubble had lengthy lasting penalties and made Japan’s economic system an anomaly throughout the international economic system – ie. close to zero development, inflation and rates of interest. Japan’s inventory market went from international outperformer to underperformer, falling 80% in 14 years.

Low Progress and Low Returns For Traders

World buyers have been understandably cautious after a 14 yr bear market. However that hasn’t been the one motive they have been reluctant to return till not too long ago. When the bubble popped, company stability sheets have been in significantly dangerous form attributable to plummeting asset costs. Firms then grew to become overcautious and held on to any money flows somewhat than reinvesting. You’ll be able to’t generate returns on invested capital in case your capital is sitting in a checking account incomes 0.01%.

The third issue that has discouraged international buyers is company governance. Till not too long ago, shareholders have had little say over company choices, and firm leaders have prioritized liquidity (i.e. having money and wholesome stability sheets) over producing returns.

Along with these main challenges, Japan’s market has by no means been essentially the most ‘consumer pleasant’ for overseas buyers. Firm data is usually onerous to return by, notably in languages apart from Japanese, and the regulatory surroundings is complicated.

Abenomics And Shareholder Returns

In 2012, the late Prime Minister Shinzo Abe carried out a brand new technique to reignite the economic system. Abenomics because it grew to become recognized was based mostly on a mix of financial easing, fiscal stimulus and structural reforms. The fiscal and financial packages have had combined successes, however did restore investor confidence. Fairness costs started their restoration in 2012, and that yr additionally marked a low level for valuations.

The structural reforms are most likely extra essential for the long run, and seem to now be paying off. Most significantly a company governance code was launched in 2014. Firms at the moment are responding to shareholders, and starting to have a look at methods to enhance shareholder returns by restructuring, shopping for again shares, and promoting unprofitable property.

The newest improvement has been the restructuring of the TSE (Tokyo Inventory Change) which took impact in April. The brand new construction encourages (and in some circumstances forces) corporations to be extra clear and shareholder pleasant, and to extend liquidity and shareholder worth.

Outdoors of company governance, Japan’s coverage makers are taking a look at methods to cut back pink tape, create a supportive start-up ecosystem, and even improve immigration to supply staff for sure industries.

If you consider a number of the political, authorized and monetary traits that make a rustic and economic system interesting to spend money on, these are a few of them.

What’s Driving the Present Rally?

The structural reforms have most likely contributed to improved profitability, however there have additionally been different catalysts driving the present rally.

The weaker Yen, and the reopening of China’s economic system has boosted exports. Japan’s inflation charge has additionally risen – one thing the BOJ has been attempting to attain for many years – which has stimulated client spending.

International buyers have additionally begun to concentrate after seeing the positive aspects on Berkshire Hathaway’s Japanese investments. In 2020 Warren Buffett started shopping for shares in Japan’s 5 largest conglomerates (proven beneath), a few of which at the moment are up greater than 200%.

The place to Subsequent?

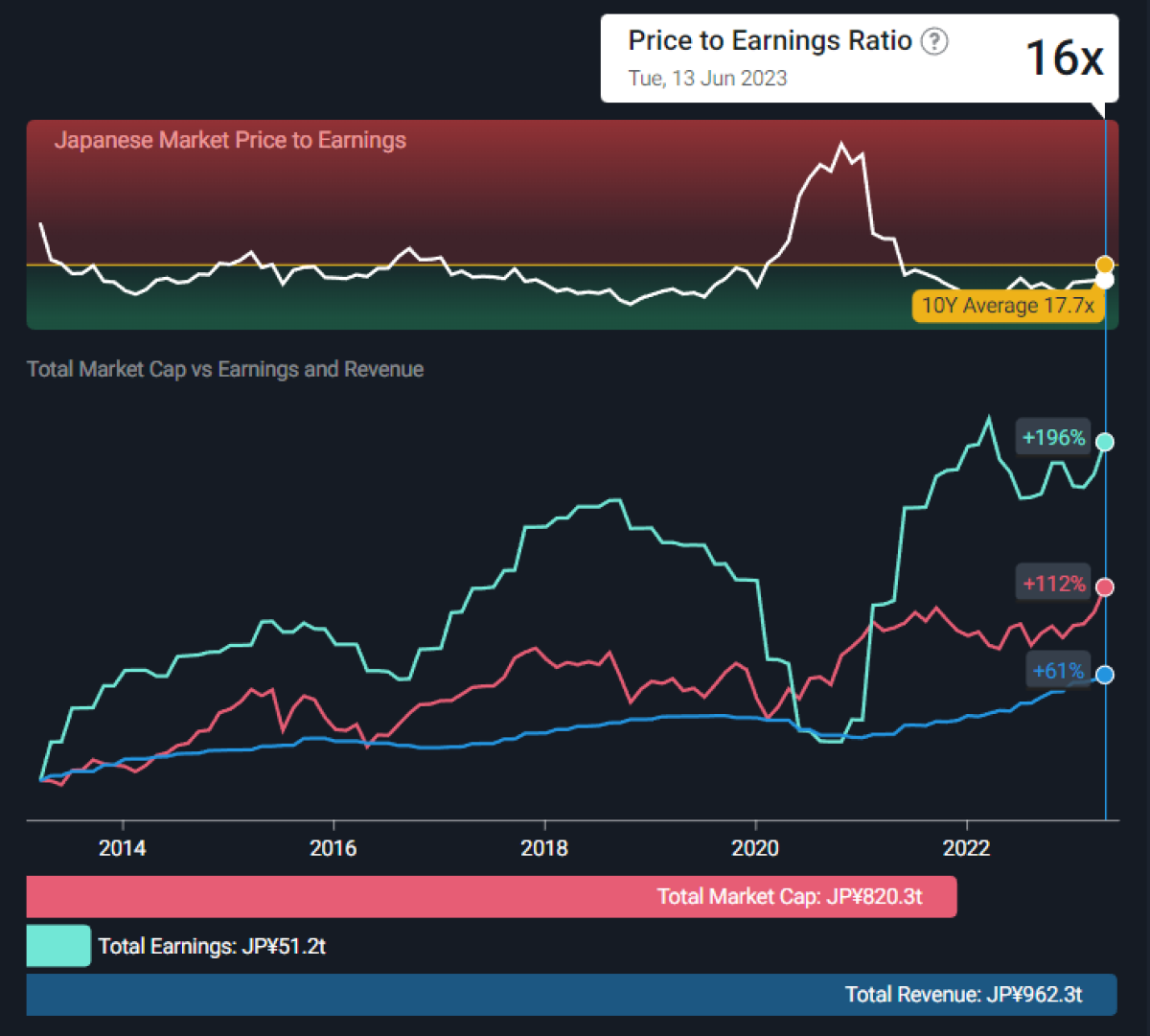

Regardless of the latest positive aspects, Japan’s common value to earnings ratio remains to be beneath the ten yr common of 17.6x. The CAPE ratio is nearer to 21x, however that’s additionally beneath common (see our latest article explaining what the CAPE ratio is for the UK market).

Whereas valuations are arguably affordable, within the medium time period the catalysts listed above might proceed to help the market – or do the other in the event that they reverse.

The longer-term image is extra attention-grabbing. The company surroundings and the economic system could possibly be utterly reworked as corporations concentrate on shareholder returns somewhat than sustaining the established order.

In the meanwhile, Japan’s inventory market isn’t very accessible to overseas buyers – simply 9 Japanese corporations price over $1 billion are listed on US exchanges. There are extra corporations listed on OTC exchanges, however most overseas buyers are presently restricted to ETFs just like the iShares MSCI Japan ETF. That is more likely to change as corporations look to enhance tradability and sources of capital.

If the reforms began by Shinzo Abe proceed, Japan might change into a brand new land of alternative for buyers.

Take a look at our evaluation on the Japanese inventory market, to get our insights on sector developments, market and sector valuations, efficiency figures and extra.

What Else is Occurring?

First a recap of the important thing information releases we talked about final week…

- 🇺🇸 The US central financial institution stored the Fed Funds Charge at 5.25% as anticipated. However Fed Chair Jerome Powell warned that the pause doesn’t imply charge hikes are over. In truth, a majority of members of the financial coverage committee count on one other two hikes this yr, with the opportunity of a minimum of yet one more hike subsequent yr.

- 🇺🇸 US Producer Costs fell 0.3% throughout the month of Might and have been simply 1.1% larger than they have been a yr earlier. This was largely attributable to decrease power costs and the impact of the stronger USD on imports.

- 🇺🇸 US Client Costs rose 4% year-on-year in Might, down from 4.9% in April. Whereas this was decrease than the 4.3% anticipated which is nice information, the core inflation charge, which incorporates the ‘stickier’ parts of inflation, fell simply 0.2% to five.3%. This means it might take some time to get the inflation charge right down to the goal stage of two%.

- 🇬🇧 UK’s employment information pointed to a stronger than anticipated jobs market. The unemployment charge fell barely to three.8%, whereas the variety of claimants fell, and payrolls rose.

- 🇬🇧 UK GDP rose 0.2% in April after falling in March. The advance was attributed to enhancing auto gross sales and client companies spending. The stronger financial and jobs information has raised the percentages of one other charge hike by the BOE.

- 🇨🇳China’s central financial institution reduce its brief time period lending charge by 0.1% to 1.9% in an effort to reignite the financial restoration which has been shedding steam since March.

After which, just a few information objects that we thought have been price noting…

-

🚙 Tesla will now be permitting each Basic Motors and Ford electrical autos to make use of its Supercharger community beginning in 2024.

- Reactions to this improvement have been combined. On the optimistic facet, it means Tesla’s charging customary will now change into the charging customary in North America. It would additionally earn new income by offering the charging service to different autos.

- Some analysts consider the corporate is giving up a key aggressive benefit – i.e. the charging community is not distinctive to Tesla. That’s true for now, but when Tesla didn’t go forward with this it might have ended up shut out from a good greater rival community.

-

🔋 Thyssenkrupp Nucera (go forward,it’s enjoyable to say!) is ready to be Europe’s largest IPO shortly. The corporate makes hydrogen electrolysers that are used to supply inexperienced hydrogen, and is a three way partnership by Germany’s Thyssenkrupp AG and Italy’s De Nora.

- Nucera might be a significant pure-play listed hydrogen firm, and provides buyers in the clear power transition a brand new itemizing to contemplate.

-

The itemizing was beforehand delayed attributable to market weak point, and the truth that its again on is one other signal of enhancing confidence available in the market.

Key Occasions Through the Subsequent Week

Fed Chair Powell’s testimony to the US congress on Thursday is more likely to be the important thing occasion for the week. Traders might be eager to listen to the replace he offers congress, and the way he solutions questions from members of the committee.

The one different notable US releases are constructing permits and housing begins on Tuesday. These will give us nice insights into the US development trade, and whether or not developments are enhancing or not.

The UK’s inflation charge is due on Wednesday, after which on Thursday the Financial institution of England (BOE) might be saying its rate of interest choice. Expectations are virtually sure on an extra charge hike, to 4.75%, with charges anticipated to shut this yr at 5.5%.

The next corporations are nonetheless attributable to report quarterly outcomes:

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team@simplywallst.com

Merely Wall St analyst Richard Bowman and Merely Wall St haven’t any place in any of the businesses talked about. This text is basic in nature. Any feedback beneath from SWS workers are their opinions solely, shouldn’t be taken as monetary recommendation and should not characterize the views of Merely Wall St. Until in any other case suggested, SWS workers offering commentary don’t personal a place in any firm talked about within the article or of their feedback.We offer evaluation based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by basic information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Adblock take a look at (Why?)