Venturing into the realm of choices buying and selling in MCX Gold and Silver can open new avenues for merchants in search of to handle threat and improve returns. Right here, we discover 4 methods that merchants can make use of to navigate the dynamic valuable metals market successfully.

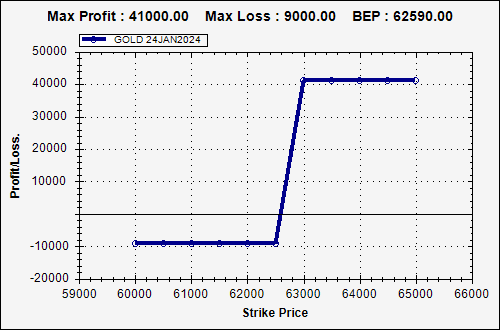

- Bull Name Unfold: In a Bull Name Unfold technique, a dealer concurrently buys a name choice whereas promoting one other name choice with a better strike worth. This technique is right when a reasonable upside within the worth of MCX Gold or Silver is anticipated. The purpose is to capitalize on the potential worth enhance whereas offsetting the associated fee by promoting a higher-strike name choice.

E.g., BUY Gold 62500CE & SELL 63000CE CMP Gold 62000. BEP (Breakeven Level) 62590

Businesses

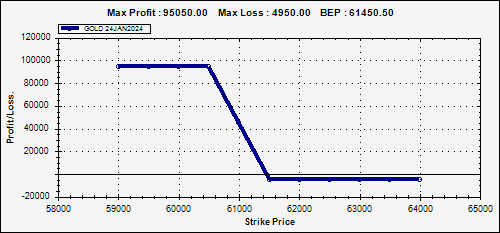

Businesses- Bear Put Unfold: Opposite to the Bull Name Unfold, the Bear Put Unfold includes shopping for a put choice and concurrently promoting one other put choice with a decrease strike worth. This technique is appropriate when a dealer expects a reasonable draw back in MCX Gold or Silver costs. The target is to profit from the anticipated worth decline whereas mitigating prices by the sale of a lower-strike put choice.

E.g., Purchase Gold 61500PE & Promote 60500. GOLD Value 62000. BEP 61450

Traders searching for twin engines of high quality and progress.

Businesses

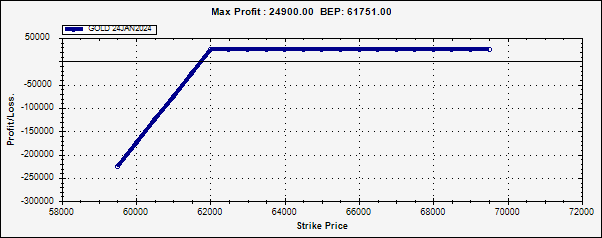

Businesses- Lined Name: In a Lined Name technique, a dealer who holds a protracted place in MCX Gold or Silver takes on a brief name place. This technique generates earnings by the premium obtained from promoting the decision choice. It serves as a conservative strategy to reinforce returns, significantly when the dealer has a impartial to barely bullish outlook in the marketplace.

E.g., Purchase Gold Fut CMP 62000 SELL 62000CE CMP 343 BEP is 61751.

Businesses

BusinessesCommon in Markets

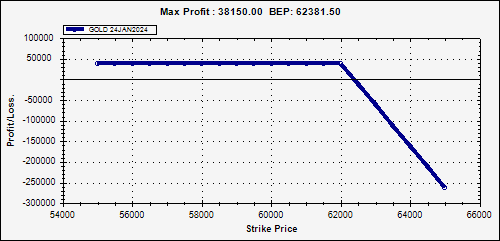

- Lined Put: In a Lined Put technique, a dealer who holds a Brief place in MCX Gold or Silver takes on a brief Put place. This technique generates earnings by the premium obtained from promoting the Put choice. It serves as a conservative strategy to reinforce returns, significantly when the dealer has a impartial to barely bearish outlook in the marketplace.

E.g., SELL Gold Fut CMP 62000 SELL 62000PUT CMP 271 BEP is 62381.

Businesses

BusinessesConclusion: These choices buying and selling methods provide merchants numerous approaches to handle threat and optimize returns within the MCX Gold and Silver market. Every technique is tailor-made to particular market expectations, permitting merchants to align their positions with their outlook on worth actions. As with all buying and selling exercise, it’s essential for merchants to completely perceive the dynamics of choices and punctiliously think about their threat tolerance and market expectations earlier than implementing these methods.

(The writer is Vice President at LKP Securities)

(Disclaimer: Suggestions, strategies, views and opinions given by the consultants are their very own. These don’t symbolize the views of Financial Instances)

Adblock check (Why?)