As a brand new dealer getting into the inventory market, you’ve got doubtless formulated a buying and selling technique. Nonetheless, having an thought alone is not ample to provoke buying and selling primarily based in your technique. There must be a strategy to validate it earlier than investing cash. This is named backtesting. Each professional merchants and algorithmic merchants more and more make use of backtesting earlier than implementing their methods.

Backtesting serves as an analytical instrument utilized by merchants to evaluate the viability and effectiveness of their buying and selling methods. It entails testing a method with historic market knowledge to judge how it could have carried out previously. This course of gives insights into a method’s strengths, weaknesses, and potential dangers earlier than implementing it in real-time.

When buying and selling leveraged devices like futures and choices, understanding the dangers, rewards, and all the things in between that your technique entails is essential.

Aryaman Singh Parmar of Algotest.in explains backtesting, “Suppose I’ve a method with particular entry and exit occasions, together with predetermined stop-loss situations. I can assess its effectiveness by persistently making use of it to a selected monetary instrument, such because the Nifty 50 Futures contracts ranging from 2019. The method entails simulating this commerce, adhering to its predefined situations each day (or any desired frequency) from the inception of the out there historic knowledge.”

“Operating a backtest of this technique will present us with a number of data equivalent to revenue/loss quantity, win and loss proportion, drawdown, and a number of other monetary ratios,” he added.

Why ought to a dealer backtest a method within the first place?

Parmar: Backtesting makes technique validation simpler by permitting merchants to see how a method would have carried out previously, making it attainable to find out the technique’s benefits and drawbacks. It additionally facilitates thorough threat and drawdown evaluation, enabling merchants to judge the utmost drawdown and associated durations, important for understanding attainable dangers and assessing a method’s resilience in difficult market situations.

Backtesting additionally gives a platform for innovation by permitting merchants to look at previous knowledge to attract conclusions. New and doubtlessly extra strong buying and selling methods that may enhance decision-making in dynamic market environments are ceaselessly developed on account of this course of.

Story continues under Commercial

In a nutshell, backtesting gives a smart method to buying and selling because it permits a dealer to get the complete image of the technique they’re constructing, enabling better-informed buying and selling choices.

What are the important thing metrics to look out for in a backtest report?

Returns, drawdowns, expectancy ratios, Calmar ratio, win and loss proportion are among the key metrics to look out for in a backtest report, says Parmar.

Returns

Assessing returns is a important facet of backtesting, as they provide a complete view of a buying and selling technique’s profitability. By analyzing the entire returns over the backtesting interval, merchants can gauge the effectiveness of the technique in producing income. Optimistic returns are indicative of a profitable technique, whereas adverse returns might sign areas for enchancment.

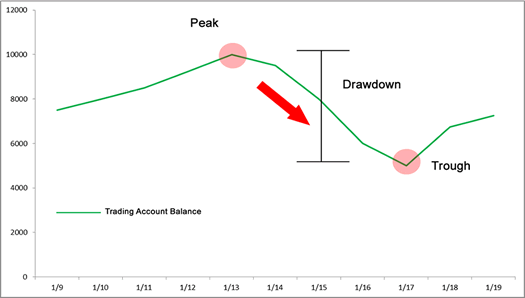

Drawdown

Understanding the utmost drawdown is pivotal for threat administration. It represents the biggest loss from a peak to a trough throughout the backtesting interval.

For instance, a drawdown of 10% for a method with capital necessities of Rs 2 lakh per lot could be Rs 20,000. Basically, the biggest fall within the Revenue and Loss curve from the height is 10 % or Rs 20,000. This metric gives essential insights into potential draw back dangers, serving to merchants establish the extent of losses the technique may incur in hostile market situations.

Expectancy ratio

The expectation ratio is a metric that signifies the common anticipated return for every rupee of threat taken. It’s calculated utilizing the system (Common Acquire Per Commerce/Common Loss Per Commerce).

For instance, with a ratio of 1.5, a dealer anticipates gaining Rs 1.5 on common for each rupee risked in a method. This system gives a quantitative evaluation of a buying and selling technique’s potential profitability in relation to its threat publicity.

Drawdown durations

Analysing the length of drawdown durations provides one other layer to threat evaluation. It helps merchants perceive not solely the depth of losses but in addition how lengthy it takes for the technique to get well from these losses. Shorter drawdown durations point out a method’s capability to bounce again shortly, contributing to general resilience.

Calmar ratio

The Calmar Ratio is a key measure to judge a method’s risk-adjusted efficiency. It provides insights into the return profile of a method with respect to its most drawdown. This tells us how successfully a method generates returns relative to the dangers taken.

It’s calculated because the ratio between annual returns and the Most Drawdown the technique displays (Return/Max DD) throughout the backtest interval. For instance, if a backtest report for a method illustrates a return of Rs 1,00,000 and a most drawdown of Rs 15,000, the R/MDD or Calmar Ratio is 6.66. A better Calmar Ratio suggests a extra beneficial risk-return profile.

Win-loss proportion:

These metrics merely illustrate the variety of occasions the technique was worthwhile in a sure backtest interval and the variety of occasions it booked a loss. Inspecting the proportion of profitable and shedding trades is prime in assessing the consistency and effectiveness of a buying and selling technique.

Let’s now run a easy backtest and analyse these ratios.

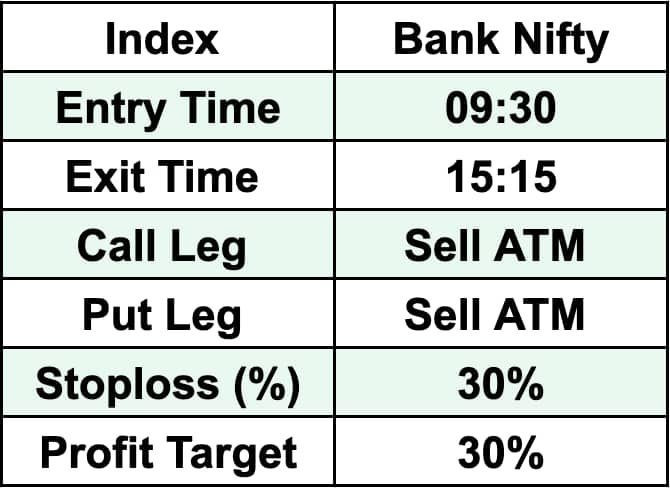

We’ll backtest a easy choices buying and selling technique on the Financial institution Nifty index between January 2017 and November 2023. The commerce particulars are as follows:

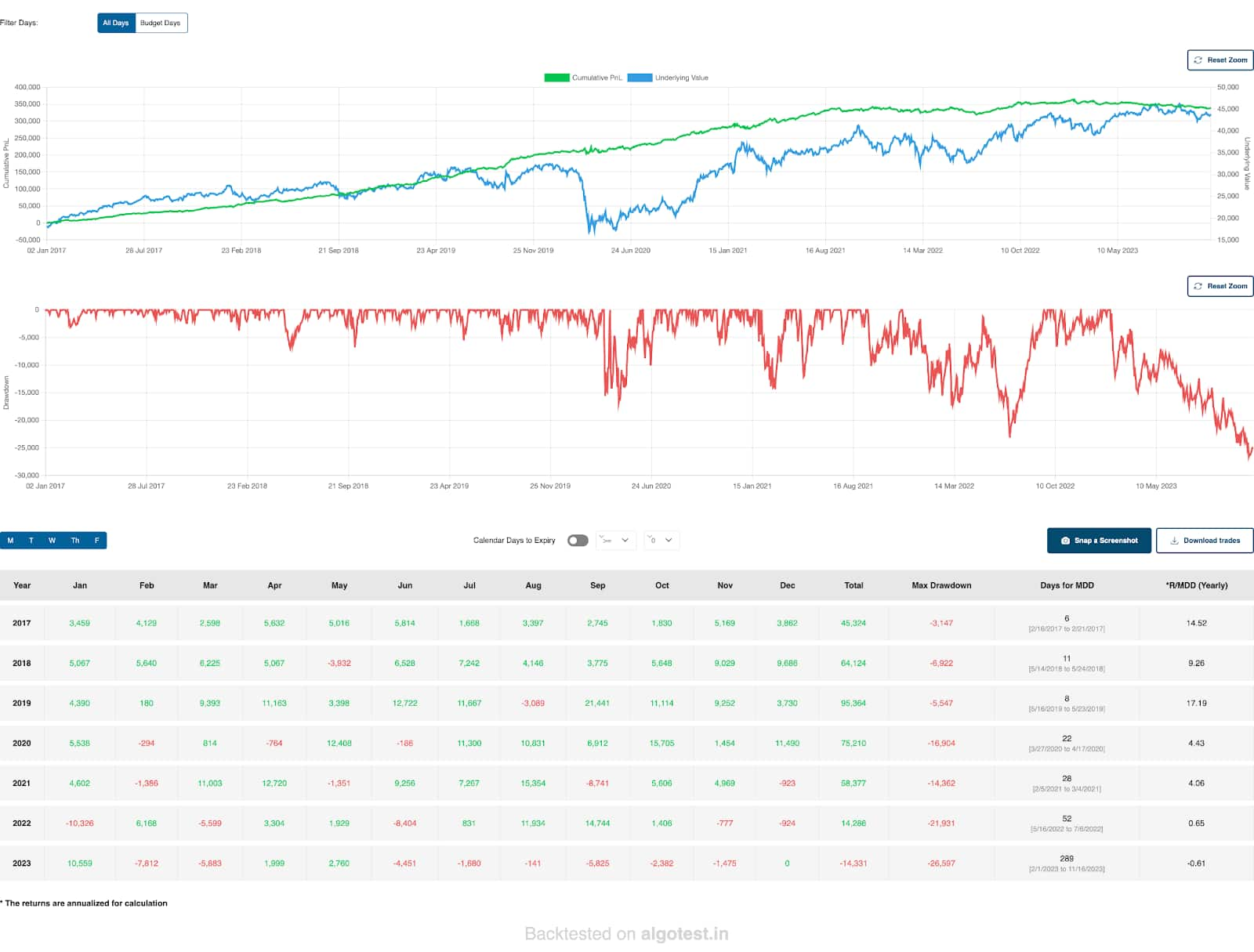

The backtest report is proven under:

Supply: Algotest.in

Supply: Algotest.in

As you possibly can see, the report is complete, together with many of the ratios talked about earlier, in addition to just a few different self-explanatory ones.

The technique has generated a return of Rs 3,38,356 in just below seven years. It additionally displays a win proportion of about 64 %, a Calmar Ratio (Return/Max DD) of 1.84, and an expectancy ratio of 0.82.

The backtest report is worthwhile, however is that this sufficient to start buying and selling with actual cash? A smart dealer will carry out just a few extra checks and processes to validate the technique earlier than doing so.

Disclaimer: The views and funding suggestions expressed by funding specialists on Moneycontrol are their very own and never these of the web site or its administration. Moneycontrol advises customers to test with licensed specialists earlier than taking any funding choices.

Adblock check (Why?)