In case anyone wanted a reminder that shares are dangerous, don’t at all times go straight up and big losses might be actual, think about hashish shares. On Feb. 11 they dropped as a lot as 50%.

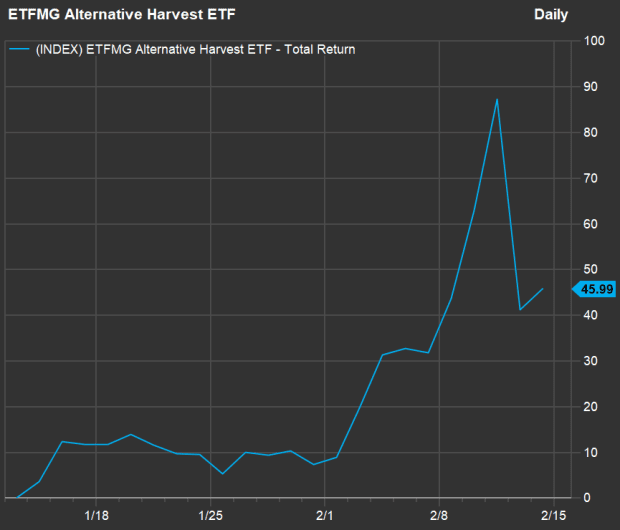

Have a look at this one-month chart, which appears as if it might be a one-year chart for the ETFMG Different Harvest ETF

MJ,

the most important trade traded fund within the sector:

(FactSet)

There are a lot of small-cap shares — not solely within the hashish sector — which might be making huge “candle sticks” like that as they make 10%-30% strikes intraday.

The inventory market appears to stay a random quantity generator. Some random small-cap inventory is likely to be value $17 in the future, $37 the following day, $79 the following morning after which shut at $44. This isn’t investing. These are random numbers generated by a four-letter image machine.

Right here’s one other instance of how random these numbers are proper now, as subscribers within the chat room ask me this kind of query time and again, as so many startup corporations come public at large valuations:

“Cody, if Rivian and Lucid Motors go public, how a lot valuation will you give every of them. I simply heard that Rivian is searching for a $50 billion valuation. Lucid claimed to have [a] superior 900-volt electrical system. Each appear virtually prepared to start out pushing merchandise out.”

I do not know tips on how to worth these corporations. We’ll have to see some income, some gross-margin projections and so forth. Do not forget that after we purchased Tesla Inc.

TSLA,

two years in the past, that after a pair years of struggling to crank out the Mannequin 3, it was being valued at $30 billion and buying and selling at simply over one occasions income.

These days, many of those startup electric-vehicle corporations are being assigned valuations that rival Tesla’s at the moment however with out the revenues or factories or established manufacturers or burgeoning charging networks or something. Is Lucid Motors, with none income or gross margins or unit gross sales but at the moment valued at near $10 billion, actually value 25% as a lot as Ford Motor Co.’s

F,

present $44 billion valuation?

Rivian is clearly an amazing firm. Amazon.com Inc.

AMZN,

invested in Rivian’s inventory on a budget a pair years in the past and promised to purchase a ton of automobiles from the corporate. I’d prefer to put money into Rivian at a good worth that features a margin of security and many potential upside. I don’t know what meaning but, as a result of we have to get extra financials and insights into the enterprise mannequin earlier than I generate a random quantity for you.

“Self-discipline: an orderly or prescribed conduct or sample of conduct.”

I typically discuss self-discipline in terms of investing and buying and selling. Self-discipline appears like an outdated idea on this market. However self-discipline by no means goes out of favor for lengthy. Self-discipline will probably be again.

Cody Willard is a columnist for MarketWatch and editor of the Revolution Investing publication. Willard or his funding agency might personal, or plan to personal, securities talked about on this column.