Investing in U.S. shares had few greater followers than the late, nice Jack Bogle.

“Should you maintain the inventory market, you’ll develop with America,” the legendary Vanguard founder instructed CNBC in 2018, lower than a yr earlier than his dying.

He famously recommended holding issues easy. Make investments by low-cost index funds (akin to Vanguard’s), he mentioned. Don’t get too intelligent by attempting to “time” the market, hoping to beat the large swings, he warned. And simply persist with U.S. shares, he suggested. He noticed no specific motive to take a position internationally.

So what would he make of in the present day’s highflying inventory market, the place the Dow Jones Industrial Common

DJIA,

the S&P 500 index, the Nasdaq Composite

COMP,

and the Russell 2000

RUT,

small-cap inventory indexes have all skyrocketed to contemporary highs.

I’d hazard to say: He wouldn’t be an enormous fan.

I’d wager he’d be warning buyers to take a second or third have a look at the dangers they’re taking of their retirement accounts—the place, in line with Vanguard’s personal knowledge, about two-thirds of the common portfolio is being gambled simply on U.S. shares.

And, most intriguing, I’m wondering if he’d change the behavior of a lifetime and be keen to wager huge on abroad markets as a substitute of simply the U.S., as just lately really helpful by the corporate he based.

I’m not saying this as a result of I’ve been again to Salem, Mass., to seek the advice of witch-doctors or commune with the useless. Bogle died in January 2019.

However we don’t should guess what he would have thought of U.S. valuations as a result of he gave us a reasonably good concept.

Two years earlier than he died, in 2017, Bogle warned that U.S. shares have been already so costly that longer-term, 10-year returns on a broad inventory market index fund have been more likely to be meager at greatest.

His forecast: About 4% a yr.

That, he mentioned, was primarily based on three issues that anybody might calculate and which had a wonderful long-term monitor document of predicting returns. He began with the dividend yield on the broad U.S. market on the time, which was round 2%. He added development in company earnings, which have been more likely to common round 4 or 5% a yr. After which he subtracted a share level or two a yr, as a result of he anticipated price-to-earnings ranges available on the market to say no again in the direction of their long run common.

That was in March 2017.

However right here’s the issue. Since then, U.S. shares have already produced all the returns he predicted for the following 10 years—after which some.

Bogle’s forecasts implied that the Vanguard Complete Inventory Market Index Fund

VTSMX,

(for instance) would rise a complete of fifty% between March 2017 and March 2027.

However it’s already risen 70% — with six years to go. To not put too superb a degree on it, however to hit Bogle’s forecasts it must lose greater than 2% a yr by 2027.

In the meantime the numbers Bogle used to construct his forecasts look even worse than they did then. The dividend yield on the S&P 500

SPX,

massive cap index is now simply 1.49%, in line with Wall Road Journal market knowledge, or 1 / 4 lower than when Bogle final checked out it.

Company earnings are going to be laborious pressed to rise greater than 5% a yr when the Congressional Funds Workplace is predicting whole gross home product to rise by lower than 4% a yr, on common, over the following decade.

Oh, and the forecast price-to-earnings ratio on the S&P 500, which was 18 when Bogle gave his interview, is now a few fifth increased at 22 instances.

All of which suggests the dangers are increased than they have been 4 years in the past and the probably consequence worse.

There are vital caveats. Bogle warned a number of instances final decade in regards to the dangers of rising U.S. inventory valuations and the probably impact on long-term returns. His warnings have been both flawed or a minimum of untimely. So you’ll be able to determine the identical applies in the present day.

All forecasts are topic to huge quantities of error. They’re guesses, even when they’re primarily based on math.

Then again, rising U.S. inventory valuations pose a significant potential threat to Individuals’ retirement plans. They might truly pose the largest single threat, as a result of U.S. shares dominate the common 401(ok) and particular person retirement account a lot.

Which brings us to a significant various to U.S. shares in your 401(ok): Worldwide shares.

We’re speaking about developed markets like Europe, Japan and Australia, slightly than the extra risky “rising markets.”

“We count on increased worldwide fairness returns over the following decade in contrast with the final, and we imagine that U.S. fairness returns can be about 8 share factors decrease than the final decade on an annualized foundation,” write Vanguard strategists in a latest observe.

They calculate that over the following 10 years, U.S. shares are more likely to achieve round 4.7% a yr on common, which works out at a complete achieve over a decade of round 60%.

Worldwide shares? They count on a median of simply over 8% a yr. That will work out at a complete achieve over the last decade of about 120%, or twice what you’ll get on U.S. shares.

All the identical caveats about forecasts apply.

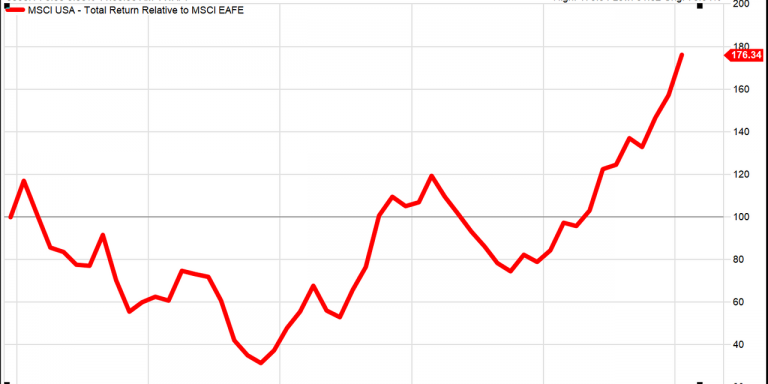

However we’ve been right here earlier than. U.S. shares beat worldwide shares within the Nineteen Nineties and within the decade simply ended. However worldwide shares beat U.S. shares within the Nineteen Seventies, the Nineteen Eighties, and the Zeros.

There’s a common tendency in finance — on Wall Road and Primary Road—to deal with U.S. shares as ‘mainstream’ and international shares as in some way dangerous and outré. That’s true even while you’re speaking about secure, developed markets in Europe and Asia. It makes no logical sense.

The U.S. accounts for simply 24% of worldwide financial output, in line with the Worldwide Financial Fund, however almost 60% of worldwide inventory market values (and 80% of U.S. buyers’ shares).

Personally, I wouldn’t have lower than half my inventory portfolio abroad — even when I believed U.S. shares have been low-cost. And proper now they don’t seem to be low-cost. I’m wondering what Jack would say?