Contemplating choices buying and selling? Begin with the fundamentals of places and calls and the way to create single-leg methods with name and put choices.

Picture by Getty Photos

Key Takeaways

- In case you’re contemplating choices buying and selling, an awesome start line is studying the distinction between calls and places

- Know when it is likely to be higher to make use of name choices methods versus put choices methods

- Discover ways to apply fundamental choices methods and the way to analyze their potential risk-reward outcomes

Whenever you strive one thing new, chances are you’ll not essentially get it instantly. It might take some repetition, however with tenacity, you’ll doubtless attain a degree the place issues begin to come collectively. Earlier than leaping in to choices buying and selling methods, it’s finest to start out with the fundamentals of name and put choices.

Why commerce choices? They are often helpful in a wide range of circumstances and market eventualities. Some choices methods may be fairly advanced, which is why it’s finest to start out with essentially the most fundamental technique. Let’s have a look at a pair basic choices methods that can assist you develop into extra aware of buying and selling choices.

Like all our technique discussions, the next is strictly for academic functions. It isn’t, and shouldn’t be thought-about, individualized recommendation or a advice.

Lengthy Choices: A Proper, however Not an Obligation

A protracted name possibility provides the proprietor the appropriate, however not the duty, to purchase the underlying safety at a particular worth (the “strike” or “train” worth) on or earlier than a particular date (the “expiration”).

A put possibility provides the proprietor the appropriate, however not the duty, to promote the underlying safety. For normal inventory or fairness choices, every contract delivers 100 shares of inventory. Non-standard choices could have completely different deliverables so ensure you perceive the phrases earlier than buying and selling.

For extra on the fundamental terminology and mechanics of choices contracts, please discuss with this primer.

Name Choices Methods

Shopping for calls as a inventory different. Shopping for a name possibility is taken into account a bullish technique as a result of the decision choices worth sometimes rises when the worth of the underlying safety rises. Equally, name costs sometimes fall when the underlying falls. The premium paid for an possibility is often a fraction of the worth of the underlying. Merchants or buyers who’ve a directional view would possibly contemplate shopping for a name possibility as a lower-cost different to purchasing a inventory outright. However there are some variations between an possibility and a inventory which can be essential to notice. Shares don’t expire, whereas choices do. In case you purchase an possibility and it expires nugatory, you lose your whole funding. Plus, choices don’t carry voting rights, nor do they pay dividends.

Promoting requires potential revenue. Some possibility merchants flip to name choices once they already personal the inventory. As a substitute of utilizing calls as a sometimes lower-cost substitute for inventory, they use calls to doubtlessly generate revenue on shares they already maintain. This technique is known as a lined name and entails promoting the choice somewhat than shopping for it. Whenever you promote a lined name, as an alternative of paying a premium, you obtain the premium. However needless to say the decision may be exercised on the will of the proprietor (purchaser) of the decision possibility at any time up till expiration. If the decision is within the cash (ITM) on or earlier than expiration, the chance that the proprietor of the choice will train his or her proper to purchase the underlying on the strike worth will increase. And meaning chances are you’ll be required to ship your inventory. Consider, nonetheless, that the brief (bought) possibility may be exercised at any time whatever the ITM or out of the cash quantity.

Utilizing the information from the desk, let’s have a look at an instance: Suppose you personal 100 shares of a inventory that’s buying and selling at $79.34. Say you’re bullish long run however don’t suppose the inventory will transfer a lot larger over the subsequent a number of weeks. So, you create a lined name by promoting a name possibility towards your inventory.

| Inventory Value = $79.34 | Name Bid | Name Ask | Strike | Put Bid | Put Ask |

| 35 days till expiration | 6.05 | 6.20 | 75 | 1.73 | 1.78 |

| 4.50 | 4.65 | 77.5 | 2.68 | 2.76 | |

| 3.35 | 3.40 | 80 | 3.95 | 4.05 | |

| 2.37 | 2.42 | 82.5 | 5.45 | 5.55 | |

| 1.65 | 1.68 | 85 | 7.25 | 7.35 |

Instance of an possibility chain. Theoretical costs for choices with 35 days till expiration. For illustrative functions solely.

Suppose you promote the 82.5 strike name on the bid worth of $2.37. You’d acquire $237 of premium ($2.37 x 100), minus any transaction prices. If the inventory stays under $82.50 between the time you purchase it and expiration, the decision will almost definitely expire nugatory and also you understand the $237 premium; that is what some name an “revenue enhancement” to the inventory you personal.

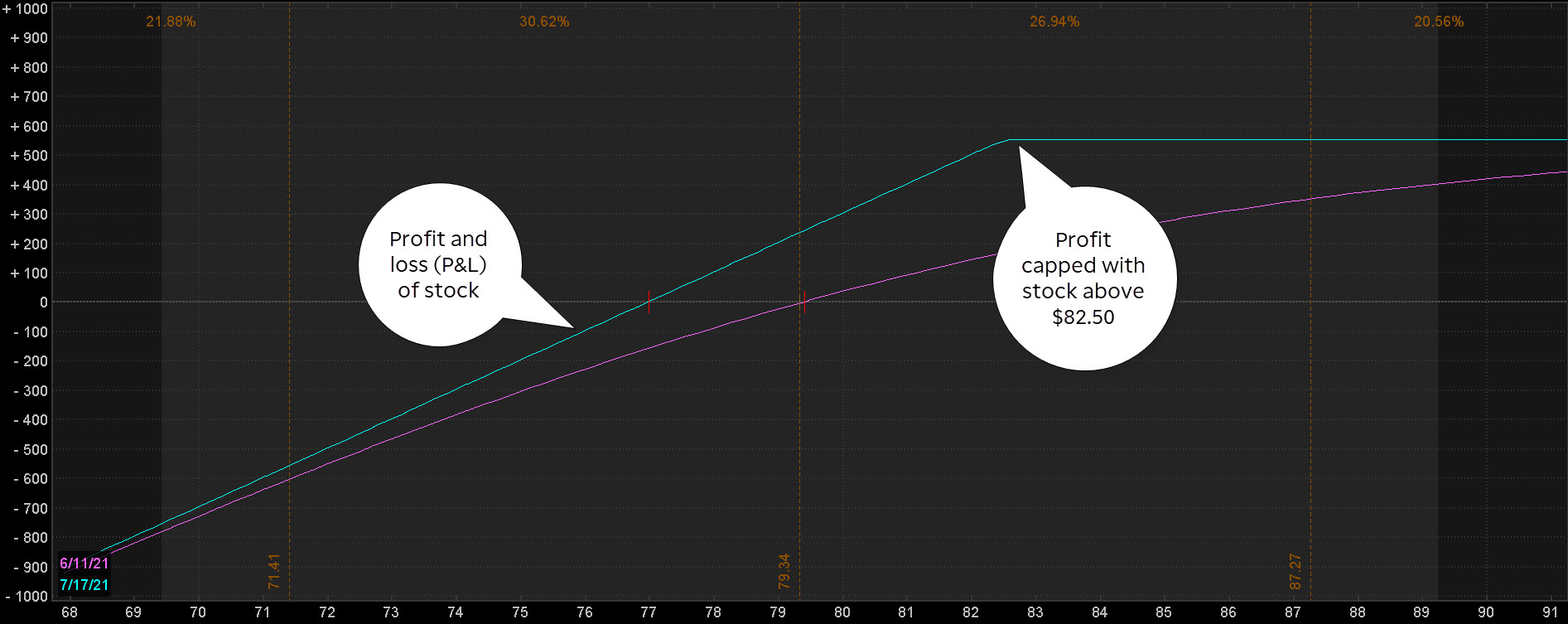

However what occurs if the inventory rallies above $82.50? You might be required to ship your inventory at $82.50 per share. Keep in mind, the inventory was at $79.34 whenever you bought the decision possibility and took in $237 of premium. So, if the inventory stays under $82.50 (and the decision possibility expires nugatory), you earned some revenue out of your inventory. If the inventory rallies above $82.50 by expiration, your return is capped at $553 ($237 premium + $316 inventory acquire), minus transaction prices. The chance curve will look just like what you see in determine 1.

FIGURE 1: RISK PROFILE OF COVERED CALL. A lined name with the inventory at $79.34 and the 82.5 strike name bought for $2.37. Chart supply: The thinkorswim® platform. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

Keep in mind the Multiplier!

For all these examples, keep in mind to multiply the choices premium by 100, the multiplier for traditional U.S. fairness choices contracts. So, an choices premium of $1 is actually $100 per contract.

Shopping for Places for Safety

Though the lined name can be utilized to doubtlessly generate revenue from a inventory, there’s one other fundamental technique that may assist restrict potential losses on a inventory you already personal—a protecting put. Shopping for a put possibility is a bearish technique as a result of the worth of a put tends to rise as a inventory worth falls and vice versa. Recall {that a} put provides the proprietor the appropriate, however not the duty, to promote the underlying on the strike worth at any time up till expiration. If the lengthy put expires nugatory, the whole value of the put place can be misplaced. This technique offers solely momentary safety from a decline within the worth of the corresponding inventory.

In case you’re bearish on a inventory, you would possibly contemplate shopping for a put in lieu of shorting the inventory. Shorting inventory may be fairly dangerous as a result of there’s no cap on the potential losses—a inventory can theoretically rise to infinity. However with the protecting put, you’re not essentially shopping for the put since you suppose the inventory goes to drop, however somewhat in case the inventory have been to drop.

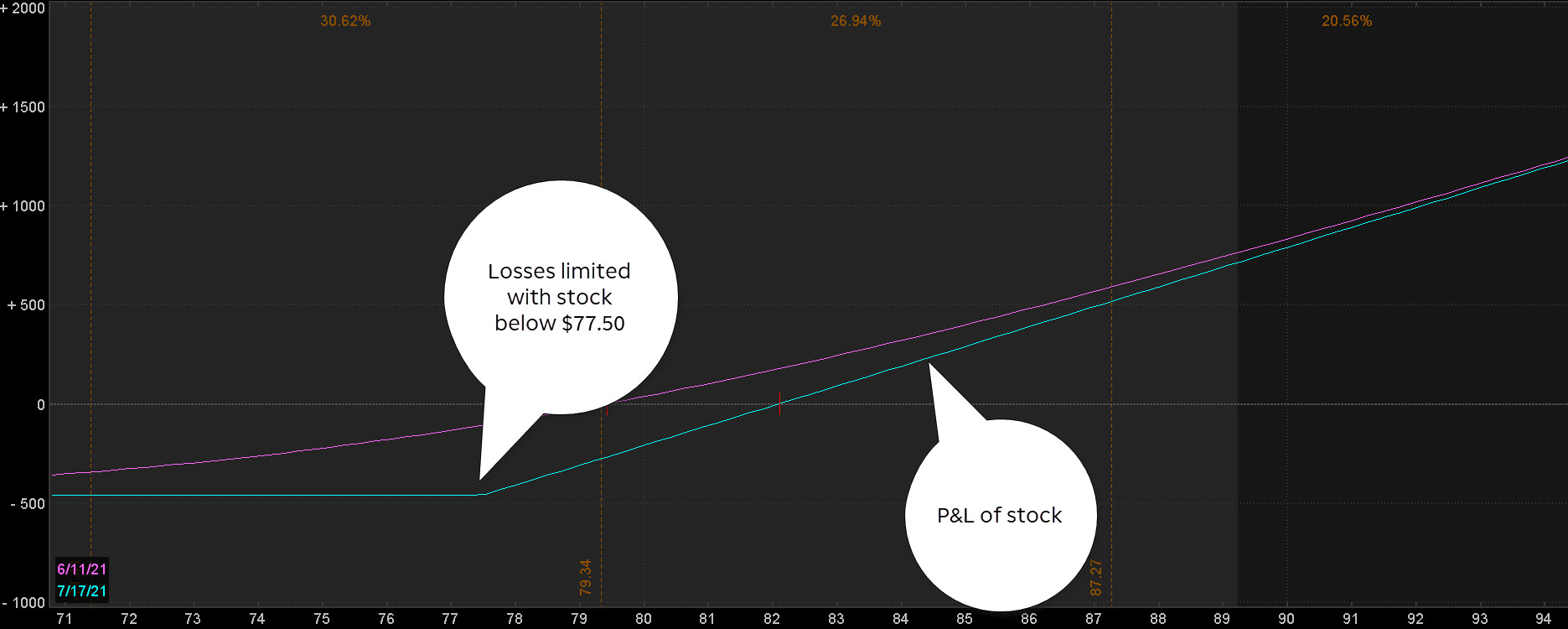

Let’s have a look at one other state of affairs. Utilizing the instance from the desk, say you personal the inventory, however you’re not snug with the considered it dropping under $77.50. Perhaps you need to defend income or maybe $77.50 represents a worth assist degree on the worth chart. Both means, paying $2.76 ($276 per contract) for the 77.5 put means you cap your loss at $4.60 if the inventory falls under $77.50 on or earlier than the expiration date of the choice. That’s the distinction between the present inventory worth and the strike worth ($79.34 – $77.50 = $1.84), plus the premium for the put ($2.76). And don’t neglect so as to add these transaction prices.

On this instance, you’ve capped your danger to the draw back, however you’ll be able to nonetheless revenue if the inventory continues to rise. Your losses are restricted with the inventory under $77.50. See determine 2.

FIGURE 2: RISK PROFILE OF PROTECTIVE PUT. A protecting put with the inventory at $79.34 and the 77.5 strike put bought for $2.76. Chart supply: The thinkorswim platform. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

Though name and put choices are actually used to make directional performs on a inventory, their makes use of transcend that. And potential revenue era and inventory safety, as we demonstrated above, solely scratch the floor of what choices methods can be utilized for.