The S&P 500 on Thursday closed above the brink that marked its exit from the longest bear market since 1948.

Listed below are some key stats from Dow Jones Market Knowledge:

-

The S&P 500

SPX,

+0.62%

had been in bear-market territory for 248 buying and selling days; the longest bear market for the reason that 484 buying and selling days ending on Might 15, 1948. - Excluding this most up-to-date bear market, the typical bear market lasts 142 buying and selling days.

- It took 164 buying and selling days from the bear-market low to exit; the longest interval from bear-market low to exiting a bear market for the reason that 191 buying and selling day interval ending July 25, 1958.

- Excluding this bear market, the typical bear-market low to bear-market exit is 61 buying and selling days.

- The index fell 25.43% from its latest excessive to its bear-market low, on a closing foundation.

- The index continues to be 10.5% off from its file shut of 4796.56, set on Jan. 3, 2022.

Underneath the factors utilized by Dow Jones Market Knowledge and plenty of different market watchers, a 20% rise from a latest low indicators the beginning of a bull market whereas a 20% fall indicators the beginning of a bear market. Which means the market is at all times in both a bull or bear market. Additionally, the market doesn’t hop into and out of both a bull or bear every time it crosses the brink once more. It takes one other 10% or 20% transfer in the other way to vary the standing.

See: S&P 500 exits bear-market territory. Will Huge Tech’s rally lastly unfold to the broader inventory market?

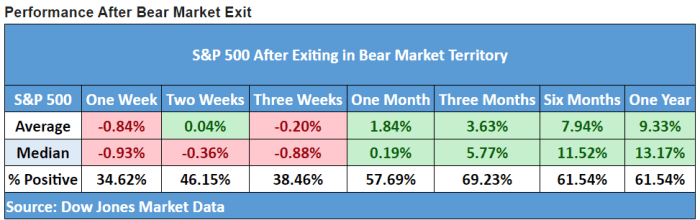

So what does historical past say about what occurs subsequent? A glance by Dow Jones Market Knowledge at median and common efficiency following previous bear-market exits, based mostly on knowledge stretching again to 1929, is essentially constructive for durations from one month to a 12 months (see desk under).

Dow Jones Market Knowledge

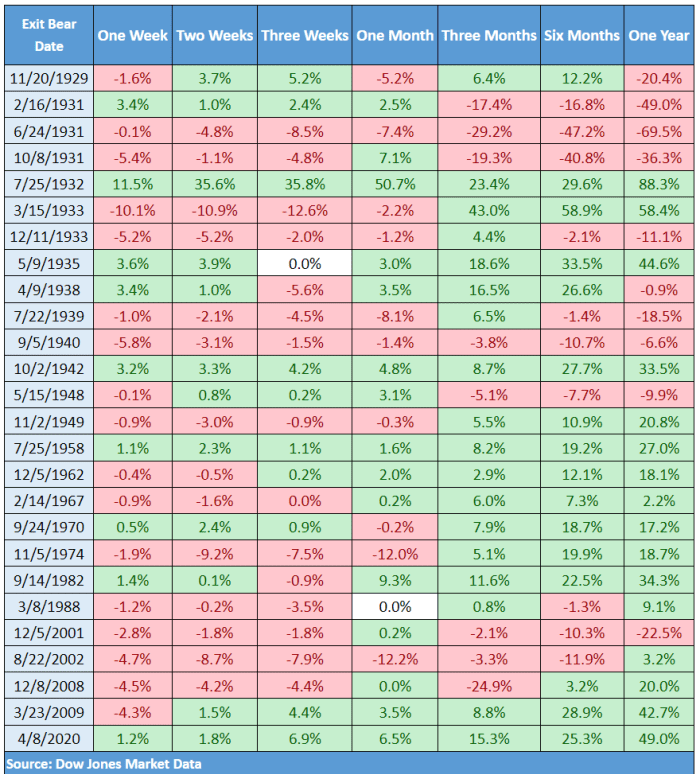

However there’s lots of variability. Right here’s a better have a look at what occurred after every exit:

Dow Jones Market Knowledge

The desk reveals that bear exits often — however not at all times — result in sturdy bull markets.

In One Chart: Why stock-market bulls should watch out for ‘bogus bear-market bottoms’

As famous earlier by Sam Stovall, chief funding strategist at CFRA, of the 14 bear markets since WWII, solely two — 2000-’02 and 2007-’09 –– produced exits that noticed the S&P 500 shortly stoop again right into a bear market by declining greater than 20%.

See: Huge Tech’s added bulk in S&P 500 in 2023 outweighs index’s vitality sector, DataTrek says

Shares have been boosted Thursday after an increase in first-time jobless claims appeared to bolster expectations the Federal Reserve will go away charges unchanged when it meets subsequent week.

The S&P 500 rose 26.41 factors, or 0.6%, to shut at 4,293.93, its highest shut since Aug. 16.

The Nasdaq Composite

COMP,

+1.02%

rose 1% to complete at 13,238.52, whereas the Dow Jones Industrial Common

DJIA,

+0.50%

gained 168.59 factors or 0.5%, to shut at 33,833.61, its highest since Might 1.

The Nasdaq exited a bear market on Might 8, whereas the Dow exited its bear on Nov. 30.

Adblock check (Why?)