A stark actuality for the euphoric inventory market? The approaching week might current the closest factor to a reckoning for bullish traders to this point in 2021.

It’s the busiest week of the fourth-quarter earnings season, highlighted by hotly anticipated outcomes from heavyweight firms like AT&T

T,

Apple Inc.

AAPL,

Fb

FB,

and Tesla

TSLA,

In all, some 118 firms are scheduled to report quarterly leads to the ultimate buying and selling week in January, together with 13 elements of the blue-chip Dow Jones Industrial Common

DJIA,

John Butters, senior analyst at FactSet analysis advised MarketWatch.

And over 60% of that weekly onslaught will play out between Jan. 27 and Jan. 28.

The frenzied interval might form as much as be a pivotal one for a market that could be trying to find its subsequent spark because the newly minted administration of President Joe Biden administration’s unfolds its coverage initiatives and plans to deal with the COVID-19 pandemic.

To date, optimism is sky excessive amongst fairness traders, with sentiment information from Ned Davis Analysis at a studying of 74.4%, a degree that it has solely achieved 7.4% of the time since 1994.

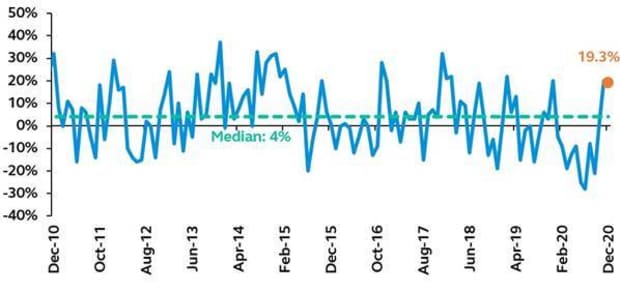

Equally, the bull-bear unfold is at 19.3% versus a median of 4% as of Dec. 31, based on American Affiliation of Particular person Buyers survey.

Supply: American Affiliation of Particular person Buyers, Principal World Buyers

Ned Davis Analysis says that the shopping for temper has apparently crushed the urge for food for bearish bets that inventory costs will face a significant near-term correction. “One factor that traders have been doing much less of is brief promoting,” wrote analysts Ed Clissold and Thanh Nguyen in a Jan. 19 analysis report.

In response to NDR information, the quick promoting ratio, the variety of shares bought quick divided by the whole points traded, hit its lowest since 2011 again in November.

One doesn’t have to go looking lengthy to seek out proof of the treacherous path that quick sellers are dealing with nowadays.

Living proof, GameStop‘s inventory

GME,

is on observe for its finest month-to-month rise in its historical past, up 245%, as retail-investing fanatics touted the inventory and urged customers on finance-oriented social platforms like Reddit to purchase the shares to squeeze activist investor and famous quick vendor Andrew Left’s Citron Analysis.

The actions of fanatic investor teams have gone past name-calling and hacking makes an attempt and included what Left described as “serious crimes such as harassment of minor children,” MarketWatch’s sister publication Barron’s wrote.

For some, that is market ebullience at its apex. Quick sellers cowering and retail investor bros making an attempt to display their newfound may.

Is that this what the precursor to a bubble looks like? Are we in a single? When will it pop, in that case?

The Fed

These are all of the questions that could be put to the Federal Reserve when it gives the backdrop to the opposite main occasion for subsequent week: the most recent financial coverage replace.

Fed Chairmam Jerome Powell has usually been blamed for each serving to to forestall a calamity in monetary markets through the onset of the coronavirus pandemic in March final 12 months as properly for fostering an excessive amount of danger taking.

The Federal Open Market Committee, which Powell heads, quickly slashed rates of interest to close 0% and pumped trillions of {dollars} of liquidity into the monetary market that had been rocked by COVID-19.

However the Fed’s insurance policies have fostered a number of the risk-taking on show, some critics argue. Bears additionally make the case that the infinite cash printing may have penalties for the U.S. greenback, for the financial system and finally monetary markets within the long-run.

Biden is proposing an extra $1.9 trillion in federal authorities spending to assist extricate the U.S. financial system from recession as coronavirus circumstances and deaths attain a brand new peak this month.

All that will confer added significance to subsequent week’s Fed gathering.

“All eyes shall be on Chair Powell at subsequent week’s FOMC assembly. We search for him to strike a extra optimistic, but cautious tone,” wrote economists Lydia Boussour and Gregory Daco of Oxford Economics, in a Friday analysis word.

In current speeches, Powell has already indicated that the Fed isn’t keen to tug again on financial coverage lodging quickly, together with elevating rates of interest from historic lows or tapering its asset purchases, a supply of help for monetary markets.

The Fed assembly kicks off on Tuesday, with Powell & Firm delivering its coverage replace on Wednesday at 2 p.m. Jap, adopted by a information convention hosted by the chairman.

U.S. financial progress?

On Thursday, a day after the Fed’s resolution, market members will await the official report card on the well being of the U.S. financial system.

In response to consensus estimates amongst U.S. economists polled by MarketWatch, the U.S. financial system might have grown about 4% on an annualized foundation within the ultimate three months of 2020, which might be phenomenal ordinarily, however comes on the heels of a 33.4% enhance within the third quarter.

Nonetheless, if the GDP studying continues to indicate upward progress, it could underscore that the financial system is transferring in the proper path even because the coronavirus pandemic continues to rage.

In spite of everything that’s mentioned and achieved if the Dow, the S&P 500 index

SPX,

and the Nasdaq Composite

COMP,

are nonetheless in spitting distance of file highs, the bulls might discover themselves much more emboldened.