By no means thoughts the hashtags, the inventory market stays removed from “crash” territory, as anybody with a working reminiscence of final March’s pandemic-inspired selloff, a lot much less the worldwide monetary disaster of 2008, the dot-com bubble burst in 2000 or October 1987 would recall.

However a rotation away from the market’s pandemic-era leaders, impressed by a sudden soar in bond yields, definitely does seem like underway, and volatility will be unsettling to some buyers.

That would assist clarify why the time period #stockmarketcrash was trending on Twitter Thursday, though the Dow Jones Industrial Common

DJIA,

and the S&P 500

SPX,

stay removed from even getting into what’s often known as a market correction, outlined as a pullback of 10% from a current peak, not to mention a crash.

The query buyers ought to ask earlier than tripping the alarm bells, nonetheless, is whether or not the worth motion is shocking or out of the unusual, Brad McMillan, chief funding officer at Commonwealth Monetary Community, informed MarketWatch in a telephone interview.

And the reply isn’t any, given {that a} backup in bond yields, which appears to largely mirror more and more upbeat financial expectations, appears to be like to be the principle wrongdoer, McMillan mentioned.

Whereas the tech-heavy Nasdaq Composite

COMP,

on Thursday entered correction territory, having registered a ten% drop from its current excessive level, the Dow Jones Industrial Common

DJIA,

remains to be simply 3.4% beneath an all-time excessive set final month. The S&P 500, the large-cap U.S. benchmark, was off lower than 5% down from its current file.

Thursday’s market weak point echoed the wobble seen final week. Each bouts of promoting had been sparked by a selloff within the Treasury bond market, which pushed up yields. The yield on the 10-year Treasury be aware

TMUBMUSD10Y,

which final week spiked to a more-than-one-year excessive at 1.6%, pushed again above 1.5% on Thursday. Remarks by Federal Reserve Chairman Jerome Powell appeared to not calm issues {that a} potential pickup in inflation might see the central financial institution start to cut back financial stimulus sooner than anticipated, however a pledge to let the economic system run sizzling.

To maintain the day’s strikes in perspective, the Nasdaq completed with a lack of 2.1%. The Dow was down greater than 700 factors at its session low, ending the day with a lack of 345.95 factors, or 1%. The S&P 500 shed 1.2%. These are sharp day by day drops, however they aren’t extraordinary.

And it’s commonplace for shares to start pulling again as yields start to rise, McMillan famous. It’s additionally not shocking that highflying progress shares, which have seen valuations stretched within the post-pandemic rally, bear the brunt of the promoting strain.

Traders seem like taking income on these highfliers and utilizing the proceeds to purchase shares of firms in sectors extra delicate to the financial cycle.

Whereas rising yields could be a optimistic signal within the early levels of a bull market, signaling stronger financial progress forward, the market rotation will be unnerving for buyers, mentioned Lindsey Bell, chief funding strategist for Ally Make investments, in a be aware.

“And better yields are inclined to hit highfliers tougher. That’s why we’ve seen shares like Tesla

TSLA,

and Peloton

PTON,

fall greater than 30% this 12 months,” she mentioned.

Certainly, the outsize weighting of tech- and tech-related shares in main indexes can depart them weak to weak point as that course of takes maintain.

The worth motion of mega know-how and discretionary shares — Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Fb Inc.

FB,

Google guardian Alphabet Inc.

GOOG,

GOOGL,

Tesla Inc. and Nvidia Corp.

NVDA,

— now make up 24% of the S&P 500, famous technical analyst Mark Arbeter, president of Arbeter Investments.

Must Know: Purchase this dip in Apple, Microsoft and these different tech shares earlier than they’re out of attain, says analyst

“The weak point in large-cap tech has been weighing on the broad market averages, sparking issues of a market high and the tip of the cycle. From our perspective, breadth stays sturdy, a attribute that’s sometimes not current at market tops,” mentioned Kevin Dempter, an analyst at Renaissance Macro Analysis, in a Thursday be aware.

Associated: The inventory market’s most delicate sector says cycle isn’t anyplace near turning

Small-cap discretionary shares are at absolute highs, in addition to multiyear highs relative to large-cap discretionary shares, he mentioned, which is an indication of broad-based participation. Developments are additionally sturdy for sectors, like vitality and banks, that are usually winners in higher-yield environments, whereas extra economically delicate teams like transports and providers are additionally benefiting.

“Slightly than a market high, we predict that is rotational in nature with restricted draw back and going ahead we wish to be chubby excessive yield winners like banks and vitality as there’s probably additional outperformance in these teams to return,” Dempter wrote.

So what about that crash? After the current bond-inspired hiccups, the Dow and S&P 500 stay removed from correction territory, a lot much less a bear market, which is outlined as a 20% drop from a current peak.

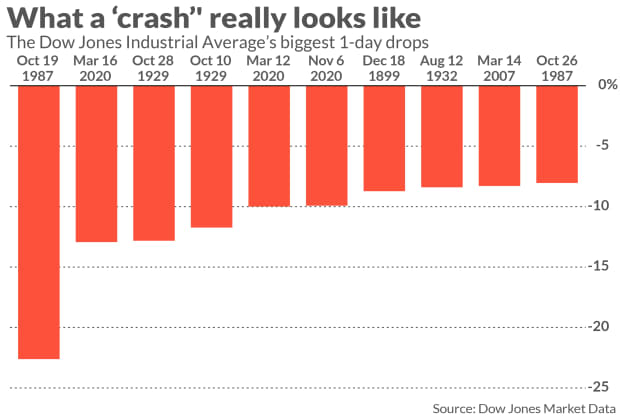

Not all bear markets are the product of a crash. And crash, itself, is a extra nebulous time period, implying a sudden and sharp fall. Some analysts outline a crash as a one-day drop of 5% or extra. Others see a typical crash as a sudden, sharp drop that takes the market right into a bear market and past in a matter of some classes.

That was the case final 12 months because it turned obvious the COVID-19 pandemic would deliver the U.S. and world economic system to a close to halt. The S&P 500 plunged from a file shut on Feb. 19, dropping round 34% earlier than bottoming on March 23.

Since these March lows, the S&P 500 stays up almost 72%, whereas the Dow has rallied almost 70%. And even with its current pullback, the Nasdaq stays up greater than 90% over that stretch.