You’re kidding your self for those who suppose you’ll know when you must reinvest the money you might have constructed up in the course of the bear market of the final 18 months.

You nearly definitely will wait too lengthy, in reality. That’s why you must undertake a plan that specifies when and the way you’ll go about returning to being totally invested.

I provide this recommendation not as a result of I’m satisfied a brand new bull market has began, although it very properly might have. However I do know which you could’t base your reinvestment determination on when it “feels proper.” That’s as a result of reinvesting in shares gained’t “really feel proper” till the highest of the following bull market bull market; that’s when the information can be at its most optimistic excessive. All of us want some plan of motion to beat the reticence we inevitably really feel the remainder of the time.

Luckily, there may be all kinds of affordable plans you possibly can undertake, and nearly any of them can be higher than doing nothing. The proper is the enemy of the nice.

My inspiration in making these assertions is a traditional essay Jeremy Grantham wrote in March 2009. Grantham, in fact, is co-founder of Grantham, Mayo, & van Otterloo (GMO), a Boston-based asset administration agency. He contended that in bear markets “these… who [are] oozing money is not going to need to simply quit their brilliance.” So they are going to be “watching and ready with their inertia starting to set like concrete.” The longer they wait to develop a plan to get again in, the higher the possibility that “rigor mortis units in.”

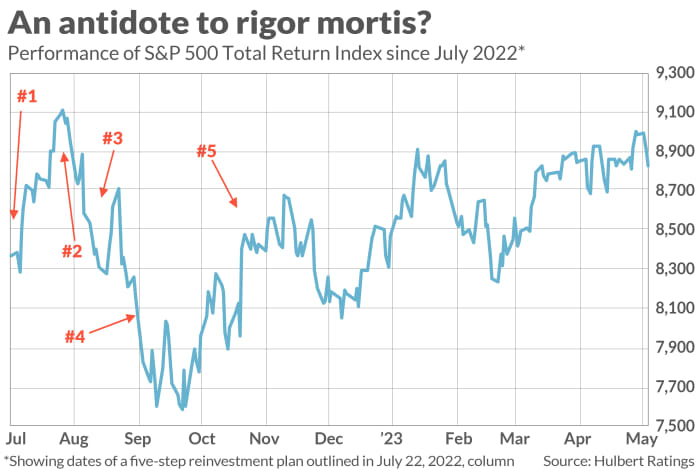

I proposed one potential such plan in a Retirement Weekly column final July, and it’s price reviewing how that plan has labored out. I prompt then that you possibly can “decide how a lot extra you’d put money into the inventory market to succeed in your required most fairness publicity stage—and divide that extra quantity into 5 segments. Make investments one phase now, and make investments every of the remaining 4, in flip, every time the inventory market rises or falls 5% from the place it stood while you invested the prior phase.”

The accompanying chart illustrates how this plan has labored out in observe. Those that adopted the plan returned to their goal weight fairness publicity by November, and have retained that publicity stage ever since.

There are a number of vital takeaways:

- One will not be significantly vital, however price mentioning anyway since I’m certain you’re curious: The plan made cash: The lump sum that was sitting in money final July is now 5.4% bigger. However this revenue will not be the purpose. You really can be higher off over the long-term had the inventory market declined by 25% or extra in a straight line after final July, wherein case the lump sum from final July can be sitting on a loss proper now. However, your common buy-in value can be loads decrease, which in flip would trigger your long-term efficiency to be higher.

- The extra vital level from a efficiency perspective is that final July’s plan assured that the common buy-in value of the quantity you reinvested can be decrease than the inventory market’s earlier all-time excessive. That’s vital, as a result of most traders who get out of the market after shares have entered a bear market wait till the market has recovered to new all-time highs earlier than investing. By doing that, in fact, they’ll lose floor relative to purchasing and holding.

- The emotional/psychological takeaway is that reinvestment plans like this one are comparatively simple to truly comply with. Adhering to it doesn’t require making any anxiety-provoking all-or-nothing selections about a whole lump sum. By as a substitute dividing that sum into a lot of tranches, you unfold that anxiousness out over time. And although there’s no denying {that a} declining market will increase anxiousness, you’ll be able to not less than considerably reduce that anxiousness by realizing that the extra the market declines the higher your long-term efficiency.

To repeat what I discussed earlier than, nevertheless: The actual reinvestment plan I prompt final summer time is only one of many you possibly can undertake. The vital factor is to select one after which comply with it.

Ready too lengthy to get again in

You probably have any doubt about how onerous it’s to get again into the market after lowering fairness publicity throughout a bear market, contemplate what occurred to the late Richard Russell, the well-known editor of Dow Idea Letters. I credit score him with making what might very properly be the perfect market-timing name of the final 40 years.

It got here in late August 1987, two months earlier than the 1987 crash, the worst in U.S. inventory market historical past. Russell, talking at an funding convention I used to be attending, took the stage to announce that the 1982-1987 bull market had ended at its Aug. 25 closing excessive. On the market’s postcrash closing low, the Dow Jones Industrial Common

DJIA,

+1.00%

was 36% under the place it stood at its late-August excessive.

Regardless of thereby establishing this unimaginable lead over a buy-and-hold method, Russell frittered it away over the next two years. He didn’t get again into the inventory market till late August 1989, two years later, when the DJIA was larger than the place it stood at its 1987 peak.

My level in strolling down reminiscence lane is to not decide on Russell. My level as a substitute is that if a market timer as achieved as Russell did not get again into the market in a well timed trend, what makes you suppose you are able to do higher?

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Rankings tracks funding newsletters that pay a flat payment to be audited. He could be reached at mark@hulbertratings.com.

Adblock check (Why?)