The S&P 500 index touched a file excessive on Friday for the fifteenth time this yr, however inventory market futures are pointing to a extra muted begin to the buying and selling week.

Even when shares can preserve rallying, the upside can be very restricted, stated Matt Maley, a strategist at funding agency Miller Tabak + Co., in our name of the day.

Maley stated there “is not any query that the inventory market might rise farther from present ranges,” however his workforce believes that any extra positive aspects gained’t be attributable to fundamentals.

That is largely as a result of the market has already priced in basic development expectations over the following 12 to 18 months. A few of these headline projections embrace year-over-year financial development estimates as robust as 8% for 2021 and earnings development of 25% this yr.

And the strategist stated that these bullish development projections are out of focus. “These are extraordinary numbers, however in case you examine them to a traditional yr, they’re not wherever close to as spectacular as they initially appear,” Maley stated. The year-over-year estimates are comparisons to 2020—when the worldwide financial system all however shut down and firm earnings have been battered by the COVID-19 pandemic.

“Extra importantly, they don’t justify an extra rally within the inventory market,” Maley stated. “One thing else goes to must gasoline a rally of significance.”

Valuations are “excessive,” in response to Maley, and this costly market “tells us that the upside may be very restricted,” with the dangers “fairly excessive” {that a} full-blown correction is coming.

The funding agency’s fundamental concern proper now’s the divergence between the S&P 500

SPX,

index and know-how shares. The blue-chip index can maintain up if there’s weak point within the tech sector, however “as soon as that weak point turns into extra pronounced, it has at all times had a detrimental influence on the broader inventory market,” Maley stated.

Each time the Nasdaq

COMP,

has fallen between 12% and 14% within the final 40 years, it has created “materials pullback” within the S&P 500, the strategist stated. “If that correction turns into greater than 15% within the Nasdaq, the S&P has at all times fallen a minimum of 10% as effectively (and often fairly a bit greater than 10%),” Maley stated.

The divergence between the S&P 500 and Nasdaq is reasserting itself as soon as once more, Maley stated. If the tech-heavy index strikes a lot decrease, it can “elevate a severe warning flag” for each the Nasdaq and the broader inventory market.

The excitement

The huge container ship that has blocked the Suez Canal and disrupted world commerce for the final week remains to be caught, however maybe not for lengthy. The Ever Given was efficiently refloated early on Monday morning and tug boats are working to straighten the ship out.

The top of final week was marked by large block trades price round $30 billion, triggered by a margin name of U.S. investor Archegos Capital Administration. The selloff pushed shares in media teams ViacomCBS

VIACA,

and Discovery

DISCA,

down greater than 27% on Friday and hit some Chinese language web shares.

And banks tied to the fireplace sale on Friday are feeling the warmth. Shares in Japan’s Nomura

8604,

and Switzerland’s Credit score Suisse

CSGN,

dived on Monday, after each teams prolonged credit score to a significant consumer that couldn’t meet its obligations. The Swiss group stated losses from exiting positions consequently might have a “extremely important and materials” influence on earnings.

It’s a gentle day on the financial entrance, with the Chicago Fed nationwide exercise index for February due at 8:30 a.m. Japanese, adopted by present dwelling gross sales information for February at 10 a.m.

Lawmakers in Albany reached a deal on Saturday to permit gross sales of hashish for leisure use, opening the door for New York to affix the rising record of states which have legalized marijuana. A vote on the invoice might come by Tuesday.

British on-line automotive retailer Cazoo is about to drift on the New York Inventory Trade in a list price $7 billion, after agreeing to a merger cope with a blank-check, special-purpose acquisition firm (SPAC). Cazoo’s deliberate merger with AJAX I’ll convey the SPAC’s billionaire investor Dan Och onto the corporate’s board.

The markets

U.S. inventory market futures are pointing down

YM00,

ES00,

NQ00,

set for a weak open to start out the brand new buying and selling week. Financial institution shares stay beneath stress within the fallout from Friday’s Archegos unwinds, with Deutsche Financial institution

DBK,

and UBS

UBS,

among the many fallers and shares in Goldman Sachs

GS,

and Morgan Stanley

MS,

decrease within the premarket.

European indexes have been blended

UKX,

DAX,

PX1,

whereas Asian equities

NIK,

HSI,

SHCOMP,

completed Monday within the inexperienced.

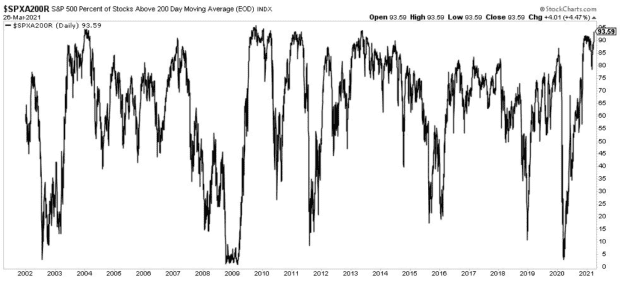

The chart

The market “is in a really wholesome place proper now,” stated Michael Batnick of The Irrelevant Investor monetary weblog. In our chart of the day, Batnick reveals that 93% of the shares within the S&P 500 are above their 200-day transferring common—the very best studying since 2013 ranges.

Random reads

There’s a sport concerning the ship caught within the Suez Canal and also you’re the bulldozer.

Life on Mars: Right here’s what the planet’s first metropolis may appear to be.

Must Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model can be despatched out at about 7:30 a.m. Japanese.

Need extra for the day forward? Join The Barron’s Each day, a morning briefing for traders, together with unique commentary from Barron’s and MarketWatch writers.