Should you appreciated the product of a listed firm and also you’re seeing the expansion potential, you should purchase the shares of that firm. Nonetheless, you must make it possible for the corporate doesn’t have an excessive amount of debt in its books.

Should you appreciated the product of a listed firm and also you’re seeing the expansion potential, you should purchase the shares of that firm. Nonetheless, you must make it possible for the corporate doesn’t have an excessive amount of debt in its books.

By Rachit Chawla

In case you are seeking to construct a corpus in these tumultuous instances, it’s essential to concentrate on two primary issues – technique (goal) and persistence. We frequently see that folks put money into mutual funds for constructing a retirement corpus, however as soon as the market reveals indicators of taking a u-turn, they cease investing and like to bail out – even taking losses within the course of.

Keep affected person

It is extremely vital to remain affected person – particularly should you’re in it for the lengthy haul. The market serves as a barometer for the Indian financial system; should you imagine within the progress story of the Indian financial system, you also needs to have some religion out there.

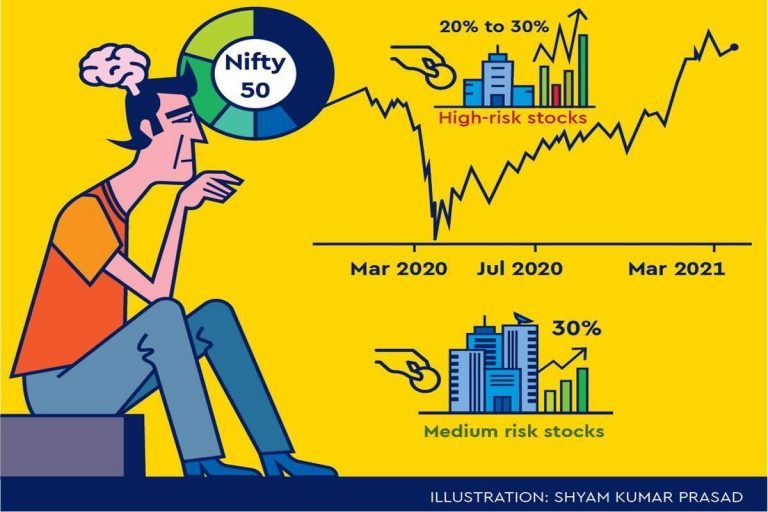

Whilst you ought to chorus from investing in firms which are susceptible to chapter, there are various protected funding choices that you may discover. You possibly can put money into the highest 50 firms of India that comprise Nifty50. These high 50 firms won’t ever shut down, so that you don’t have to fret about dropping in the long term. Additionally, one of the best factor about Nifty50 is that if an organization shouldn’t be performing nicely, it steps down and the 51st firm takes its place – thereby sustaining the integrity of the Nifty50 index. Everytime you’re in for the long term, you must keep affected person because the market would finally bounce again after the disaster subsides. Nonetheless, should you’re in it for the brief run, then you definitely’d be higher off chopping your losses.

Good wealth technique

If we discuss wealth technique, you possibly can divide your corpus in three or 4 methods. The primary one which we must always talk about is the high-risk path.

Should you appreciated the product of a listed firm and also you’re seeing the expansion potential, you should purchase the shares of that firm. Nonetheless, you must make it possible for the corporate doesn’t have an excessive amount of debt in its books. Moreover poor governance, failure to repay debt is the main trigger for the sudden closure of firms.

Additionally, you shouldn’t make investments greater than 20% to 30% of your funding capital in high-risk shares. The opposite 30% you possibly can put money into medium threat shares, which incorporates mutual funds. You possibly can put money into equities by way of mutual funds in addition to in small caps as they’re low-risk shares. Add capital periodically everytime you see your portfolio in pink.

The bottom threat funding possibility is the Nifty index. Within the long-term, it’s only going to develop, as its progress is immediately influenced by the expansion of the highest 50 firms of India – which is a certainty.

Efficiency rating

The quartile rating reveals how your scheme has carried out quarter on quarter compared to your friends. If the scheme you’ve opted for goes beneath the third quartile in a few consecutive quarters, it may be time so that you can exit the scheme.

Ratio evaluation

The danger to return ratio is a powerful indicator of whether or not your scheme is working the best way you need it or not. By doing thorough ratio evaluation, it is possible for you to to get a clearer image of how your scheme is performing.

Complete expense ratio

Since fund administration and distribution-related bills are borne by the scheme, the next expense ratio would end in decrease returns. Due to this fact, it’s one thing that ought to by no means be uncared for whereas evaluating the efficiency of a scheme.

The author is founder & CEO, Finway FSC

Get reside Inventory Costs from BSE, NSE, US Market and newest NAV, portfolio of Mutual Funds, Take a look at newest IPO Information, Greatest Performing IPOs, calculate your tax by Revenue Tax Calculator, know market’s High Gainers, High Losers & Greatest Fairness Funds. Like us on Fb and comply with us on Twitter.

![]() Monetary Specific is now on Telegram. Click on right here to affix our channel and keep up to date with the most recent Biz information and updates.

Monetary Specific is now on Telegram. Click on right here to affix our channel and keep up to date with the most recent Biz information and updates.