Per week of drowsy buying and selling acquired no raise from the most recent prospect of extra authorities spending.

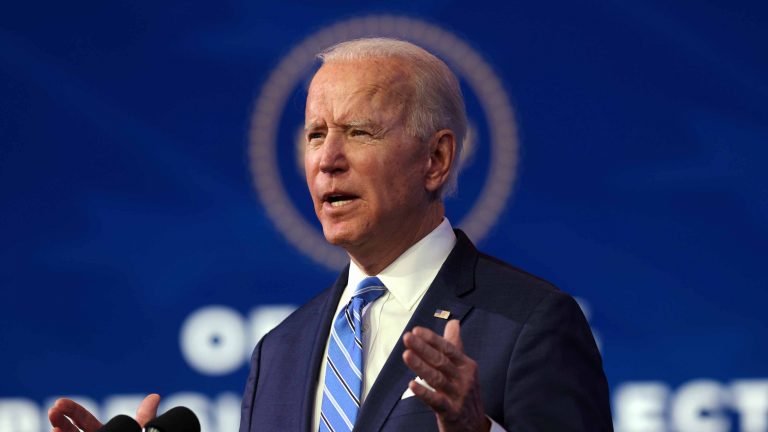

President-Elect Joe Biden on Thursday night unveiled a $1.9 trillion “American Rescue Plan” that features various provisions, together with $1,400 stimulus checks, supplemental unemployment advantages and a $15-per-hour federal minimal wage.

And but, shares went pink on Friday.

Maybe Wall Avenue had already baked in all of its expectations for the much-anticipated plan. Or maybe the market remained distracted by COVID itself, which continues to be taking a hefty toll right here within the U.S. because the vaccine rollout appears to crawl ahead. Additionally of some concern was the beginning of the This fall earnings season – blended outcomes from Citigroup (C, -6.9%) and Wells Fargo (WFC, -7.8%) weighed on these shares and the remainder of the monetary sector.

The Dow Jones Industrial Common closed 0.6% decrease to 30,814, and the remainder of the most important indices adopted go well with.

Different motion within the inventory market immediately:

- The S&P 500 took a 0.7% spill to three,768.

- The Nasdaq Composite broke again under 13,000, dropping by 0.9% to 12,998.

- The Russell 2000 dropped arduous off its all-time excessive, dropping 1.5% to 2,123.

- Gold futures weren’t exempt, dipping 1.3% to settle at $1,827.80 per ounce.

- U.S. crude oil futures lastly cooled off, dropping 2.4% to $52.31 per barrel.

- Bitcoin costs, at $39,633 on Thursday, plunged greater than 10% to $35,579. (Bitcoin trades 24 hours a day; costs reported listed here are as of 4 p.m. every buying and selling day.)

- Tesla (TSLA, -2.2%) shares declined after receiving a Avenue-high $950 worth goal from Wedbush analyst Daniel Ives, however not a Purchase suggestion.

Turbulence Forward?

Whereas optimistic about 2021 total, many analysts predicted some bumpiness, particularly in Q1, and we could be on the onset of 1 such tough patch.

“Now we have pretty excessive conviction in two issues,” says Canaccord Genuity fairness strategist Tony Dwyer. “Situations stay ripe for a brief correction that ought to give again a lot of what has been gained since late final 12 months, and when it comes, buyers are prone to imagine it’s one thing extra sinister than an overbought correction.”

One factor that stood out clearly Friday was a flight to income-producing equities. Throughout the Dow itself, three of the 5 finest performers had been so-called “Canines” – the commercial common’s highest-yielding shares as of the beginning of the 12 months.

Enterprise growth firms (BDCs), a high-yielding however low-traffic space of the market, additionally outperformed.

And actual property, a lot maligned in 2020, earned some consideration Friday. Actual property funding trusts (REITs) are well-known amongst earnings buyers given their mandate to show over at the very least 90% of their taxable income by way of money distributions to their shareholders. Lots of them at the moment sport higher-than-normal yields after a tough 2020, making them a one-two punch of earnings and rebound potential as soon as the American financial system settles again onto its observe. Examine them out.