Prime Minister Chris Hipkins pronounces Labour’s tax coverage forward of the 2023 common election, in Decrease Hutt on 13 August, 2023.

Picture: RNZ / Angus Dreaver

Labour’s GST-free fruit and greens tax coverage is being broadly panned by specialists, who say it’s betting on voters’ ignorance.

Introduced on Sunday, the coverage would see GST faraway from unprocessed recent and frozen fruit and greens, alongside a lift for Working for Households.

Requested if he may identify an economist or tax specialist who supported the GST change, chief Chris Hipkins got here up brief – so RNZ has approached a dozen and sought their views on the matter.

Lisa Marriott

Affiliate professor of taxation at Victoria College, Lisa Marriott

Picture: Equipped

“I hope it does not see the sunshine of day,” Victoria College professor of Taxation Lisa Marriott mentioned. “To be completely sincere, I believe it is one of many worst concepts I’ve heard for some time.

“It is actually unlikely that each one that saving might be handed by to customers. And since it is on merchandise like fruit and greens that do fluctuate there’s going to be no solution to maintain supermarkets to account on this.

“The opposite foremost factor is the integrity of the tax system: now we have a extremely good GST system exactly as a result of we do not have all these exclusions that different international locations have. And I now see that that is getting used as justification, and we’re being referred to as ‘an outlier’ nevertheless, I believe just about each different nation on this planet would look to us and say that now we have a system, which is way preferable.

“And I believe as soon as this cat is out of the bag … it is most likely one thing which might be troublesome, if not not possible, to truly reverse.”

Eric Crampton

Picture: provided

“Creating holes in GST is a horrible thought. It solely turns into interesting when a celebration is down within the polls,” New Zealand Initiative chief economist Eric Crampton mentioned.

“It is sophisticated, it is annoying, it provides an terrible lot of price to operating a tax system, it makes all people’s tax returns extra sophisticated… and it is all for nothing. It does not offer you any profit.

“It is a wager that voters are too silly to know tax coverage. I hope that voters aren’t.

“New Zealand is called having some of the clear consumption taxes that exists, it isn’t riddled with holes, and that signifies that it is ready to gather an terrible lot of cash for the federal government at a comparatively low tax fee… solely Hungary collects about as a lot income out of its consumption tax relative to GDP as New Zealand does – and their consumption tax fee is 27 %.

“Plenty of issues are attainable. Not all of these issues are a good suggestion.”

Craig Renney

Council of Commerce Unions (NZCTU) coverage director and economist Craig Renney.

Picture: Stuff / ROBERT KITCHIN

“It would not be my first selection if we had been going to do that, however it’s undoubtedly one thing that is price exploring,” Council of Commerce Unions chief economist and director of coverage Craig Renney – a former advisor to Finance Minister Grant Robertson – mentioned.

“There are many examples from abroad of plenty of challenges which have been put in place in delivering these sorts of reforms… the extent to which that change is captured by supermarkets, or whether or not they find yourself being captured by customers… in order that’s why they would not be my first selection.

“There are extra direct routes to place cash in folks’s pockets.

“I’d slightly do that than do a tax change [like National’s] which provides the vast majority of the change to increased revenue earners, that is a way more regressive strategy… I’d slightly do that than take away the 39 % fee on revenue tax, which is ACT’s coverage, for instance.”

Ranjana Gupta

AUT senior taxation lecturer Ranjana Gupta.

Picture: Equipped / NZ Herald

“The wealthy folks will get extra profit as a result of they spend extra,” AUT senior taxation lecturer Ranjana Gupta mentioned. “Inequity will improve as a result of the profit will go extra within the pockets of wealthy folks.

“Low revenue households will save solely $2 per week and for them the saved cash is extra helpful – and they’ll spend it to purchase – say, garments, or pay lease or purchase meat or another items.

“And little doubt the sellers will begin categorising the products incorrectly and there might be fraud … so the GST assortment for IRD might be lesser and to analyze these kind of frauds or inappropriate behaviour of the sellers it has to spend extra on administrative [costs].”

Brad Olsen

Infometrics senior economist Brad Olsen.

Picture: Equipped / James Gilberd Photospace

“If you’ll find an economist that helps this coverage, they do not deserve the title,” Infometrics principal economist Brad Olsen mentioned.

“These are the types of insurance policies that sound good on paper, don’t ship in actuality, and are oversold… in actuality, that is as a lot of a tax lower to millionaires as revenue tax aid can be.

“First, it is not focused to folks that want the assist essentially the most – in actual fact, it provides extra dollar-for-dollar to these on increased incomes – and the federal government may properly have given the bottom half of New Zealanders literal money funds, and it will have been a extra focused coverage. Secondly, it’s complicated to manage… And third is there isn’t any assure that these price financial savings are literally handed on to customers.”

Labour’s declare the Grocery Commissioner may make sure the financial savings had been handed on to the buyer didn’t stack up, he mentioned.

“They can’t be certain that… the Tax Working Group itself mentioned that they’d be fortunate to get 30 % pass-through coming by.”

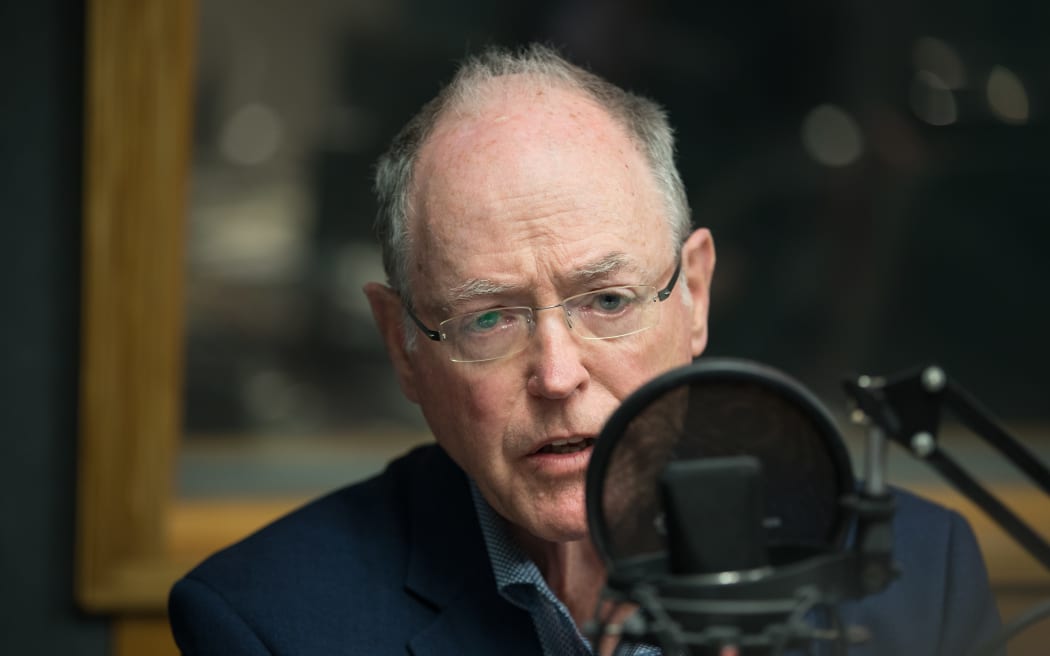

Don Brash

Picture: RNZ / Cole Eastham-Farrelly

“It is a signal of desperation,” Don Brash, who chaired the committee which designed New Zealand’s GST system, in 1985, and was later elected as chief of Nationwide and ACT, mentioned.

“It’s a politically opportune factor to do. I have been shocked at how many individuals I meet with who say, ‘Yeah, why not? It sounds a good suggestion’. It’s a actually silly thought.

“It is a very inefficient manner of serving to the folks you most wish to assist – presumably, low revenue folks. Many of the cash spent on meals and greens is spent by center and excessive revenue folks, so that you give away a variety of income as a authorities for little or no profit to the folks you most wish to assist.

“Why not additionally books and kids’s clothes and physician’s payments? There are a complete raft of issues which you might justify as being exempt – very quickly in any respect, you have acquired a Swiss cheese of a tax, having to push up the speed of of GST on all the pieces else.

“Sure, plenty of different international locations do have exemptions – and many different international locations, as a consequence, have a lot increased GST charges. The international locations that do have exemptions, I think want they did not.”

Terry Baucher

Terry Baucher

Picture: Equipped

“It is an costly choice for little acquire,” Baucher Consulting head and tax specialist Terry Baucher mentioned.

“There is no doubt it is common. That is what their polling will inform them, however that is as a result of folks assume it will have a larger profit than it really may have.

“I do not assume taking GST off recent fruit and veg solves the issue of individuals not having sufficient cash. And likewise, the place do you draw the road? As soon as you’re taking it off recent fruit and veggies, what’s to cease exempting different stuff?

“If you are going to do one thing of common software, then altering the tax fee thresholds, and so on, perhaps a tax-free threshold would obtain the identical end result however be extra economically environment friendly … not fairly tax impartial however coherent from a tax coverage perspective.”

Paul Smith

“From a tax coverage perspective, it isn’t a good suggestion,” EY associate for GST Paul Smith mentioned.

“Internationally, New Zealand’s GST system has been held within the highest regard. It is often known as probably the greatest GST methods on this planet and that is as a result of it is vitally easy. There are only a few exemptions. It is broad primarily based, and it is a extremely environment friendly tax.

“Sure, different abroad international locations exempt quite a lot of issues, however the compliance price in these abroad jurisdictions is manner increased than the compliance price is in New Zealand.

“When you’ve got an exemption for meals then it perhaps begins to open up arguments about, ‘properly, why do not we introduce increased charges of GST for luxurious gadgets reminiscent of luxurious automobiles’, so after which you find yourself with a really complicated GST system – which is what we have been attempting to keep away from.”

Robin Oliver

Robin Oliver

Picture: Equipped

“Fascinating? No,” OliverShaw skilled in tax economics and coverage Robin Oliver mentioned. “It’s workable, you might make this work, however it’s important to have a really clear boundary.

“It isn’t a coverage I assist. I do not assume it is the tip of the world, by the way in which, however the hazard is the political strain then turns into all people after all can begin providing concessions for GST to fulfill political moods.

“As soon as you’re taking it off one thing, how do you cease? We even have GST on medical doctors charges. How do you justify that?

“Ultimately, you find yourself with a really slim base and if you wish to gather the identical quantity of GST, you would need to massively improve the GST fee on all the pieces else that you simply do catch. So should you halve what you are taxing it’s important to double the speed to gather the identical amount of cash.”

Susan St John

Picture: RNZ / Cole Eastham-Farrelly

“It is a populist thought,” Little one Poverty Motion Group economics spokesperson Susan St John mentioned. “It is one which has enchantment to most people who do not actually perceive all of the complexities of doing it.

“It is most likely one of many least price efficient methods for serving to people who find themselves struggling to feed their households.

“The advantages might be proven to be appropriated largely by the upper revenue folks as a result of they spend extra on recent fruit and greens, and it does not essentially change behaviour on the decrease finish simply by making these issues cheaper when folks do not find the money for. In the event that they had been to have a couple of further {dollars} of their pockets, they could not essentially wish to spend it on recent fruit and greens. So it simply does not stack up from an economics standpoint.

“If what you are attempting to do is to get decrease revenue households feeding their kids nutritious meals, this isn’t the way in which to do it … that is simply tinkering.”

Sir Robert McLeod

Sir Rob McLeod

Picture: Ngatiporou.com

“We have a tendency to explain that as a GST stuffed with holes,” businessman, skilled director and Enterprise Spherical Desk tax specialist and former chair Sir Robert McLeod mentioned.

“Individuals exploit these holes both intentionally or by accident and it does result in much less GST being collected for the tax base within the nation than is in any other case achievable.

“The compliance and administration prices in tax is massive, and folks are inclined to ignore these… certainly, there are some research that recommend that these administration and compliance prices are the most important element of the deadweight lack of taxes, tax prices, they usually undergo the roof as quickly as you complicate the design of the system.

“The motivation right here is just not tax coverage, income, and the tax system: The motivation is to please voters. Is not that fairly apparent, or is that too cynical?”

Craig Macalister

Findex tax advisory associate Craig Macalister

Picture: Equipped

“The fundamental backside line is that eradicating GST simply is not a wise manner of reducing meals costs,” Findex tax advisory associate Craig Macalister mentioned.

“Regardless of the ostensibly well-meaning intentions of these pushing the concept, the straightforward reality is such an motion lumps undesirable compliance prices on companies and invitations a go to from that outdated foe unintended penalties.

“GST applies to all end-user customers of products and companies and is a good revenue-raising tax. If the federal government cannot stability its books, there are solely two choices: borrow or elevate taxes elsewhere.

“If we take away GST from meals gadgets, why cease there? It turns into arduous for any Authorities to retain GST on different requirements reminiscent of toiletries or well being merchandise and the like.

“Briefly, whereas everybody sympathises on meals costs, tinkering with the GST system is just not a successful formulation. New Zealand’s GST regime is the envy of the world due to its simplicity, making income assortment simple whereas limiting the price of assortment.”

Adblock take a look at (Why?)