This text explores the vital position of the selection of crop insurance coverage unit within the US crop insurance coverage program. Farmers can select from 4 insurance coverage items: primary, optionally available, enterprise, and complete farm. Manufacturing danger and premium subsidy range by unit sort. Farmers can decrease their premiums by selecting enterprise or complete farm items. Over the 2011-2022 crop years, these two items skilled decrease insurance coverage loss ratios and offered farmers extra insurance coverage indemnity funds per greenback of farm-paid premium. Use of enterprise unit has been growing however varies by crop and area. Entire farm items are little used. When evaluating crop insurance coverage coverage proposals, you will need to remember that farmers can select from insurance coverage items which have totally different efficiency options.

Knowledge and Strategies

The supply for the info used on this research is the US Division of Agriculture, Threat Administration Company State/County/Crop Abstract of Enterprise. The info set additionally consists of solely the person farm insurance coverage merchandise of income safety (RP), income safety with harvest value exclusion (RPHPE), and yield safety (YP). These merchandise had been launched within the 2011 crop 12 months and replicate the final main premium ranking overview. The 2011-2022 crop 12 months research interval additionally postdates the final main improve in premium subsidies — the 2008 farm invoice improve in subsidies for enterprise items (Collins).

Insured Items

A farmer with multiple insured farm can select from 4 insurance coverage items.

- Non-compulsory Unit (OU): Every surveyed part is insured individually.

- Primary Unit (BU): Insurance coverage is by farmer share of manufacturing, not by land part. Premiums are decrease than for optionally available items as excessive manufacturing on one part can offset a loss on one other part.

- Enterprise Unit (EU): All sections and shares planted to a crop in a county are mixed. The farmer takes on extra danger as extra alternative exists for offsetting modifications in manufacturing. Multi-County Enterprise Unit can be accessible for farms that cowl multiple county.

- Entire Farm Unit (WU): All insurable acres of all insured crops planted in a county may be mixed into one unit. Since multiple crop is mixed in a complete farm unit, the potential for indemnity funds is decreased attributable to offsetting modifications in manufacturing of various crops. Entire farm unit will not be the identical as Entire Farm Income Safety (WFRP) insurance coverage.

Federal premium subsidy charges are larger for enterprise and complete farm items than for primary and optionally available items (see Determine 1). Thus, coverage favors use of insurance coverage items that insure extra aggregated or mixed manufacturing danger throughout items of manufacturing. Importantly, subsidy charges are decrease at larger protection ranges, however complete premiums are larger at larger protection ranges which can lead to larger {dollars} per acre of subsidy.

Insurance coverage Unit Tendencies

The share of legal responsibility insured in enterprise items elevated steadily from 46% in 2011 to 63% in 2022 (see Determine 2). The shares in optionally available and primary items declined from 35% to 24% and from 19% to 13%, respectively. Entire farm unit share rounded to 0% in yearly.

Efficiency by Insurance coverage Unit

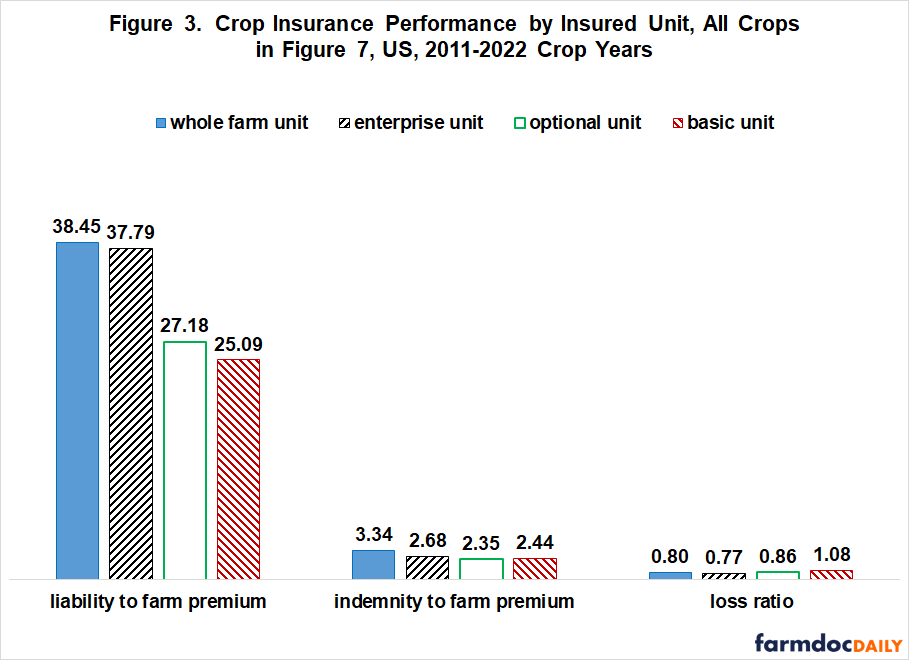

In comparison with optionally available and primary items, enterprise and complete farm items had

- the next ratio of legal responsibility to farm-paid premium, a measure of how a lot insurance coverage safety the typical farmer purchased per greenback of premium paid; and

- the next ratio of indemnity to farm-paid premium, a measure of common charge of return to farmers on the premium they paid (see Determine 3).

The favorable efficiency of enterprise items on these two farmer-related efficiency measures is in keeping with the growing use of enterprise items (see Determine 2).

A typical measure of insurance coverage efficiency utilized by insurance coverage suppliers the loss ratio – was notably larger on common for primary items over the 2011-2022 crop years.

Word, for complete farm items these measures of insurance coverage efficiency must be used and interpreted with warning as use of complete farm items is proscribed.

Enterprise Unit by Crop

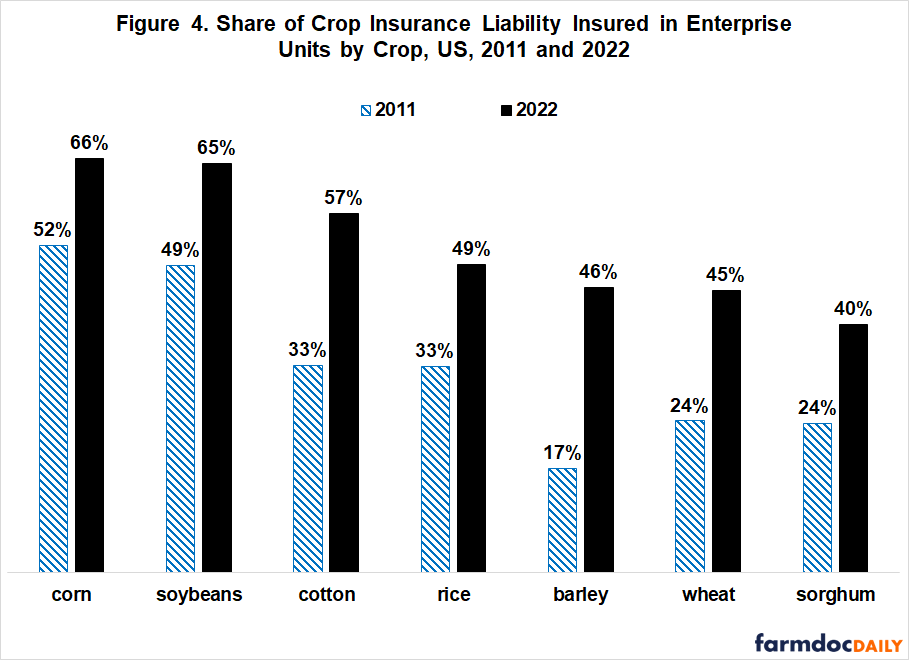

Use of enterprise items varies notably by crop (see Determine 4). For 2022, share of insured legal responsibility in enterprise items ranged from 66% for corn and 65% for soybeans to 40% for sorghum. Nonetheless, for every of the 7 crops in Determine 4 use of enterprise items has elevated since 2011. Corn has the best utilization and thus smallest improve of 14 share factors (66% up from 52%). The crops included in Determine 4 are the 4 largest acreage discipline crops and the regionally vital crops of barley (Northern Nice Plains), rice (South plus California), and sorghum (Southern Nice Plains).

Enterprise Unit for Corn by State

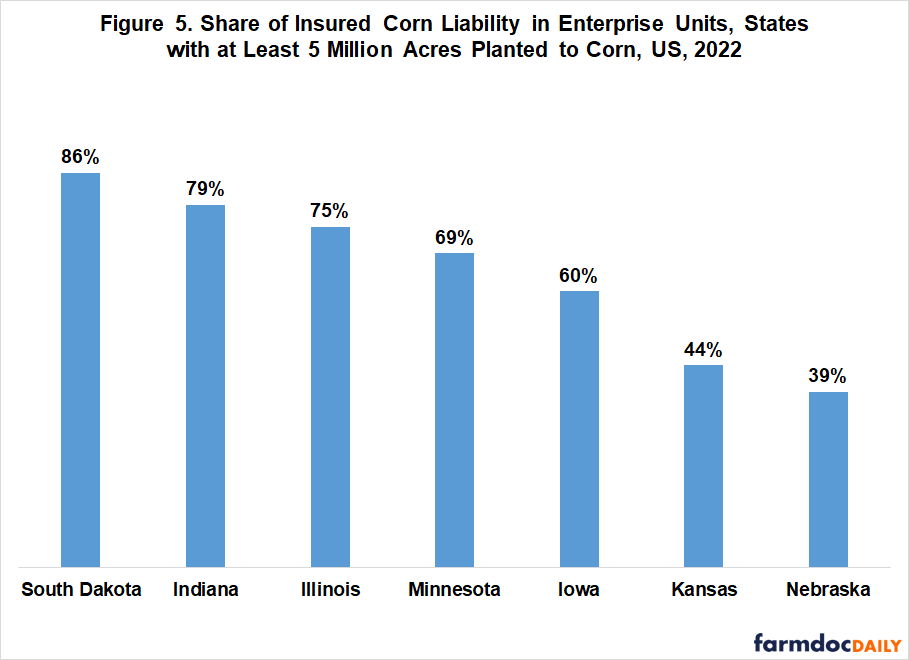

Determine 4 reveals that the usage of enterprise unit varies throughout states. To additional examine, we compute the share of insured legal responsibility in enterprise items for 2022 corn in states with at the least 5 million acres planted to corn. Enterprise unit shares range from 86% for South Dakota to 39% for Nebraska, or by greater than an element of two (see Determine 5). This massive variation throughout states implies that farmer selection of insurance coverage items impacts the online insurance coverage premium paid by farmers.

Dialogue

When discussing US crop insurance coverage, you will need to think about the position of insurance coverage unit. Premium subsidy and farmers’ share of manufacturing dangers range throughout the 4 kinds of insurance coverage items. The realized loss ratio additionally range by insurance coverage unit (and protection degree). An implication is that the efficient subsidy charge might differ from this system subsidy charges in determine 1.

A basic tenet of insurance coverage principle is that insurance coverage consumers know extra about their dangers than insurance coverage suppliers. In consequence, insurance coverage premiums are often decrease when an insurance coverage purchaser is prepared to tackle extra danger. This tenet is especially related when the manufacturing operate varies by web site, as with crop manufacturing.

One other basic tenet of insurance coverage principle is that Insurance coverage can encourage consumers to interact in dangerous conduct if premiums and protection will not be aligned with the mitigation of losses from dangerous conduct. Economists name this impact ethical hazard. Caps on premiums, corresponding to that proposed within the June 5, 2023 farmdoc every day, would create extra danger and end in larger loss ratios by additional breaking the hyperlink between premiums and danger publicity. Greater danger manufacturing must be mirrored in larger premiums with a view to result in comparable loss ratios as required by crop insurance coverage laws.

Good crop insurance coverage public coverage requires balancing foundational tenets of personal market insurance coverage principle with the historic remark that, apart from hail insurance coverage, the non-public sector is unlikely to offer crop insurance coverage whereas US society has determined to subsidize provision of crop insurance coverage.

Given this balancing act, a coverage rationale for the present, larger premium subsidy for enterprise and complete farm items is that manufacturing danger throughout a number of manufacturing websites is diversified in comparison with primary or optionally available items, and is extra aligned with farmers’ precise complete farm income danger. Mixed final result insurance coverage additionally mitigates ethical hazard.

Since 2011, enterprise and complete farm items have had decrease insurance coverage loss ratios, particularly relative to primary items, and offered farmers with extra legal responsibility protection and extra indemnities per greenback of farmer-paid premium. The latter two options seemingly assist clarify the growing use of enterprise items.

A doubtlessly vital query for the US crop insurance coverage program is whether or not the present premium subsidy schedule throughout the insurance coverage unit choices is sweet coverage. Particularly, why is the premium subsidy the identical for complete farm and enterprise items and the identical for optionally available and primary items when danger is probably going much less for complete farm than enterprise unit and for primary than optionally available unit? Furthermore, does the upper loss ratio for primary items since 2011 counsel its use must be additional restricted by lowering its premium subsidy, particularly for crops with larger loss ratios?

Lastly, it is not uncommon to listen to complaints about variations in farm-paid premiums throughout states and crops. You will need to do not forget that farmer selection of insurance coverage unit, together with precise loss expertise, are seemingly components in these variations. They should be thought-about when assessing modifications to crop insurance coverage packages.

References and Knowledge Sources

Bullock, D. and S. Steinbach. “Financial Penalties of Capping Premiums in Crop Insurance coverage.” farmdoc every day (13):102, Division of Agricultural and Shopper Economics, College of Illinois at Urbana-Champaign, June 5, 2023.

Collins, Ok. July 23, 2017. The Use of Enterprise Items in Crop Insurance coverage. Mississippi State College Extension Agricultural Economics Weblog. https://blogs.extension.msstate.edu/agecon/2017/07/23/the-use-of-enterprise-units-in-crop-insurance/

US Division of Agriculture, Threat Administration Company. Might 2023. State/County/Crop Abstract of Enterprise. Sort/Apply/Unit Construction Knowledge Recordsdata and File Structure. https://www.rma.usda.gov/en/Info-Instruments/Abstract-of-Enterprise/State-County-Crop-Abstract-of-Enterprise

Adblock take a look at (Why?)