- US Treasury must challenge an approximate whole quantity of US$1.1 trillion in T-bills in H2 2023 to replenish its working money stability.

- Absorption of the US$1.1 trillion of T-bills issuance could set off a big liquidity squeeze.

- Liquidity situations within the US have began to tighten strengthened by a rise in implied volatility of US Treasury bonds and a much less dovish Fed.

- Persistent Ok-shaped efficiency led by mega-cap expertise shares in US inventory indices enhance the danger of a draw back correction.

A puff of aid for international monetary markets because the US White Home administration and the Republican party-controlled Home has managed to strike a tentative debt ceiling extension and suspension deal that lasts for 2 years earlier than the newly introduced “X-Date” of 5 June by US Treasury Secretary Janet Yellen earlier than the US authorities runs of money to pay for its obligations.

Proper now, it’s all about convincing the “hard-core” factions of each camps; the conservative Republicans and progressive Democrats to vote for the deal which nonetheless has a component of uncertainty. Within the shorter time period from the attitude of “animal spirits” within the monetary markets, risk-on behaviour persists as each the US S&P 500 and Nasdaq 100 futures have added to final Friday’s features with intraday each day returns of +0.20% and 0.40% respectively in as we speak’s Asian session at the moment of the writing.

Quite the opposite from a medium-term horizon, the US inventory market appears to be ignoring or complacent on a possible important liquidity drain within the monetary markets ex-post US debt ceiling extension deal settlement by Congress.

After Congress handed the deal, the following step for the US Treasury might be a furore of US Treasury payments (T-bills) issuance to quicker shore up its dwindling money reserves to satisfy its debt and cost obligations. The US Treasury’s working money stability stood at US$38.84 billion as of 25 Might, its lowest stage since September 2017.

Therefore, the US Treasury must replenish its coffers by a complete issuance of round US$1.1 trillion price of T-bills within the second half of 2023 which might be absorbed by banks’ reserves through deposits and in a single day funded trades with the Federal Reserve in addition to cash market mutual funds. If extra absorptions are completed through cash market mutual funds, the pressure on liquidity is more likely to be muted.

Prior to now two weeks, liquidity and monetary situations have began to tighten as seen from a number of key main indicators.

Constructive momentum has began to built-up within the 10-year US Treasury yield

Fig 1: 10-year US Treasury yield pattern as of 26 Might 2023 (Supply: TradingView, click on to enlarge chart)

Firstly, the benchmark fee for company loans and bonds issuance, the 10-year US Treasury yield has risen by 34 foundation factors because the week of 15 Might and surpassed the important thing upward-sloping 200-day transferring common to final commerce on final Friday, 26 Might at 3.81%, a stage that preceded the onset of the latest US regional banking turmoil in mid-March. From a technical evaluation perspective, the each day RSI has recorded a momentum bullish breakout, rising the percentages for an additional potential upside above 3.90% for the 10-year US Treasury yield.

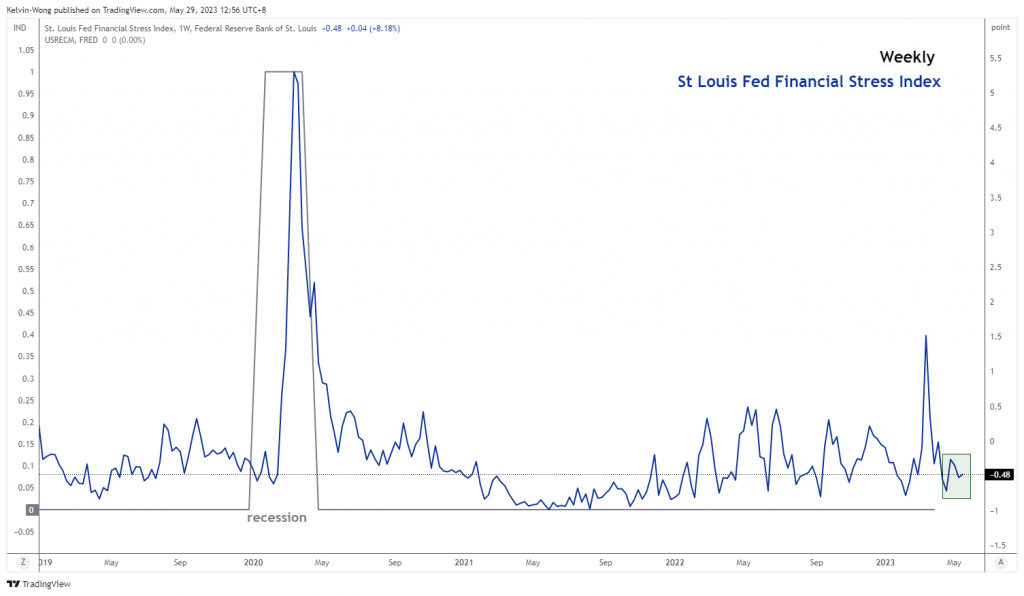

US monetary stress situations have began to tick larger

Fig 2: St Louis Fed Monetary Stress Index as of 15 Might 2023 (Supply: TradingView, click on to enlarge chart)

Secondly, the St Louis Federal Reserve Monetary Stress Index has additionally began to tick as much as its newest studying of -0.48 for the week of 15 Might from its prior week of -0.52 and former a “larger low” which may point out an early signal of liquidity tightening situations.

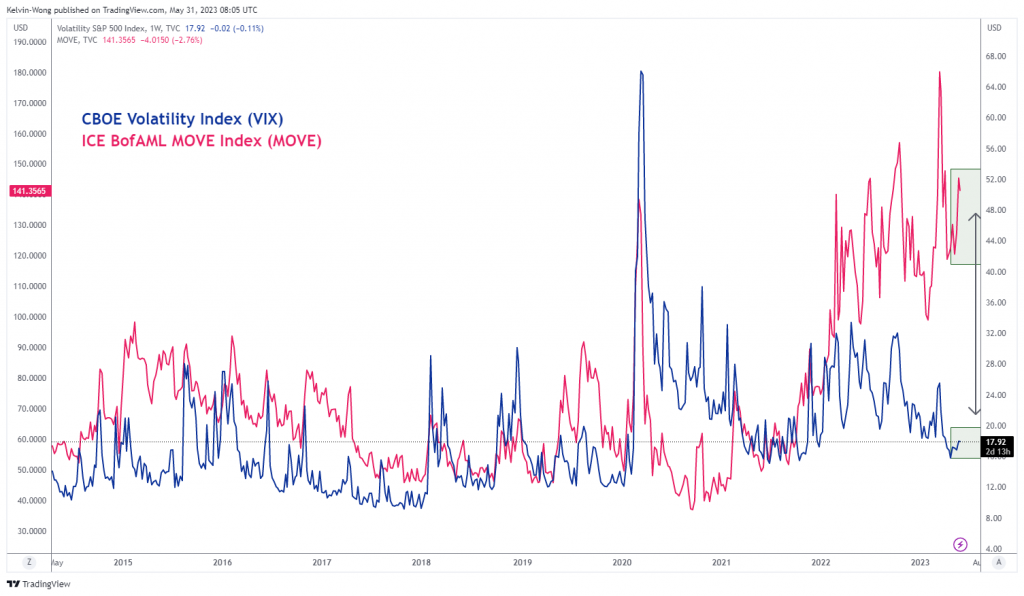

Implied volatility in US Treasury bonds has remained at an elevated stage

Fig 3: ICE BofAML MOVE Index & VIX as of 26 Might 2023 (Supply: TradingView, click on to enlarge chart)

Thirdly, the implied volatility within the US Treasury bonds market inferred by the ICE BofAML MOVE Index has remained at an elevated stage the place it ticked larger final Friday, 26 Might to 145.37, a stage that was final seen through the onset of the US regional financial institution turmoil in March. These newest observations seen within the MOVE Index counsel that costs of US bonds may even see additional draw back strain and in flip, set off an additional rise in mounted earnings/bonds yields that create a probably heightened liquidity squeeze surroundings.

Fed’s pause for upcoming June FOMC has evaporated

The fourth issue, the expectations of a Fed’s Pivot to kickstart its rate of interest lower cycle earlier than 2023 ends has began to lose momentum. Primarily based on the newest information from the CME FedWatch software (inferred from the pricing of Fed funds fee futures), the preliminary excessive likelihood of a pause on the Fed funds fee at 5.00% to five.25% for the 14 June 2023 FOMC assembly seen 4 weeks in the past has dissipated after the newest sequence of “Fed communicate”. Proper now, the Fed funds fee futures are pricing a 65.3% likelihood of a 25-basis level hike on 14 June.

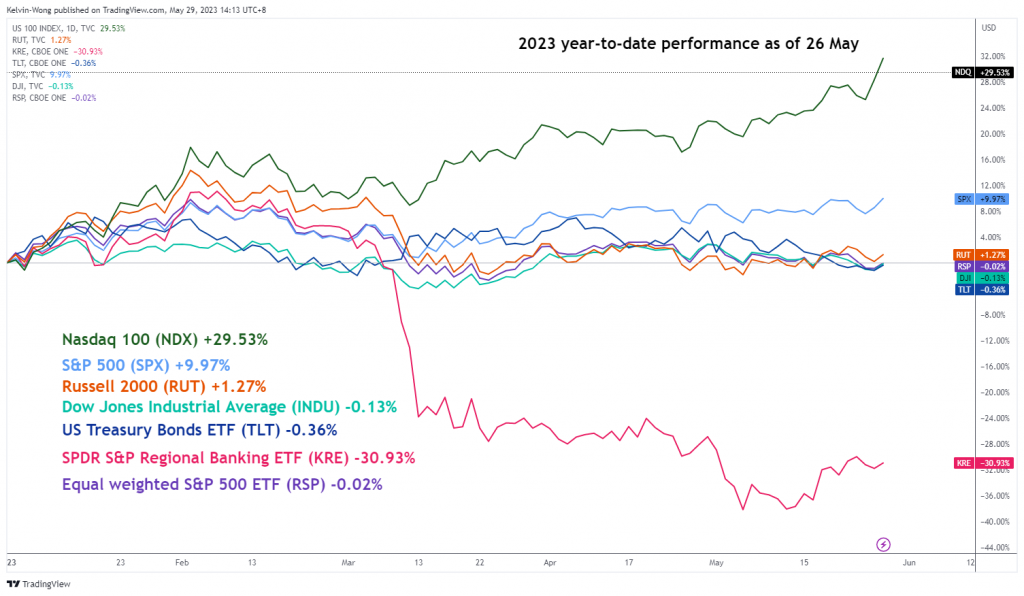

“Ok-shaped” efficiency within the US inventory market continues to persist

Fig 4: 2023 year-to-date performances of US inventory indices as of 26 Might 2023 (Supply: TradingView, click on to enlarge chart)

The loop-sided “Ok-shaped” efficiency has continued to persist within the US inventory market since its October 2022 swing low. The benchmark inventory indices; Nasdaq 100 and S&P 500 are closely weighted by the mega capitalization expertise shares primarily the FAANG plus MNT group (Meta/Fb, Apple, Amazon, Netflix, Alphabet/Google, Microsoft, NVIDIA & Tesla) have continued to outperform the remainder (Dow Jones Industrial Common & Russell 2000) by a large margin.

Due to the present AI-driven optimism theme play, the share value of NVIDIA staged a spectacular single-day rally of +24% final Thursday’s ex-post earnings announcement that skyrocketed Nasdaq 100’s 2023 year-to-date return to round +30%.

Quite the opposite, if we stripped out or normalized the weights of those mega capitalization expertise shares, the US inventory market efficiency is rather like a “speck of mud” the place the equal-weighted S&P 500 ETF has turned unfavourable (-0.02%) for the yr.

Subsequently, if such a “Ok-shaped” efficiency persists on the Nasdaq 100 and S&P 500, the percentages are seemingly going to get larger for a draw back correction to slim the hole as a liquidity-tightening unfavourable suggestions loop can spiral simply into an more and more weak US inventory market breadth, an analogous incidence that was seen in March final yr.

Content material is for common info functions solely. It isn’t funding recommendation or an answer to purchase or promote securities. Opinions are the authors; not essentially that of OANDA Enterprise Data & Providers, Inc. or any of its associates, subsidiaries, officers or administrators. If you want to breed or redistribute any of the content material discovered on MarketPulse, an award successful foreign exchange, commodities and international indices evaluation and information web site service produced by OANDA Enterprise Data & Providers, Inc., please entry the RSS feed or contact us at information@marketpulse.com. Go to https://www.marketpulse.com/ to search out out extra in regards to the beat of the worldwide markets. © 2023 OANDA Enterprise Data & Providers Inc.

Adblock take a look at (Why?)