Traders are more and more allocating a bigger portion of their portfolios—which stay closely skewed in direction of equities, actual property and gold—to debt.

Traders are more and more allocating a bigger portion of their portfolios—which stay closely skewed in direction of equities, actual property and gold—to debt.

Illustration: Chaitanya Dinesh Surpur

Imagine having the ability to make double-digit returns with decrease ranges of threat and volatility than fairness investments. That’s a deal few would spurn.

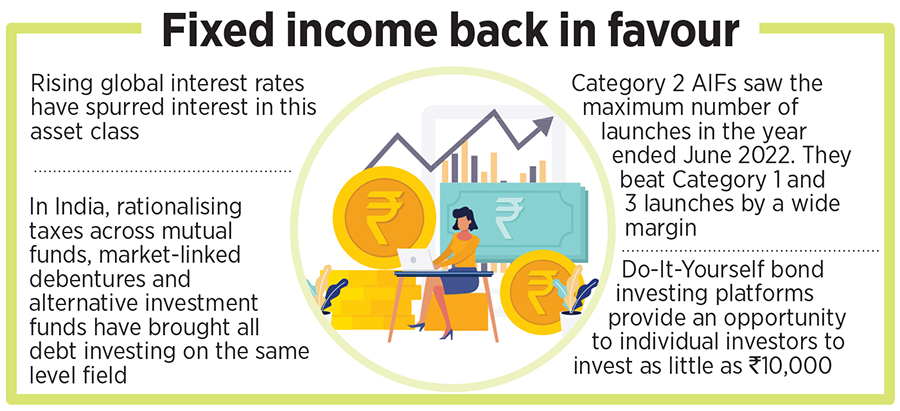

That can be the promise that debt funds maintain. Within the final 18 months, as rates of interest globally have headed north so have investments into this asset class. The US 10-year authorities bond, thought-about a proxy for the worldwide risk-free price, now trades at 3.6 p.c—up 250 foundation factors within the final 18 months. In consequence, all debt investments globally are providing increased yields. The consensus on rates of interest remaining increased for longer signifies that these investments ought to keep in favour for fairly a while.

The state of affairs is not any totally different in India on account of each increased yields in addition to a current change in tax legal guidelines. Traders are more and more allocating a bigger portion of their portfolios—which stay closely skewed in direction of equities, actual property and gold—to debt. With markets at nearly-all-time highs and earnings progress within the excessive teenagers, they’ve toned down their expectations of future returns from equities.

For Indian traders on the debt entrance, there’s lots to select from. The overall excellent inventory of bonds in India stands at $2.3 trillion of which company bonds make up $509 billion, in line with knowledge from the Clearing Company of India and the Securities and Change Board of India. “Globally, the dimensions of the bond markets is 1.2 to 1.4 instances the GDP,” in line with Vishal Goenka, co-founder of Indiabonds.com, a bond shopping for platform.

Adjustments to tax legal guidelines have additionally introduced all types of debt investing at par. In February, the Price range eliminated the beneficial tax remedy accorded to market-linked debentures In late March, the Finance Invoice introduced debt mutual funds additionally below the slab price.

This meant that in impact all lessons of debt—from fastened deposits to authorities bonds and mutual funds to different funding funds (AIFs)—are actually taxed equally. It eliminated the tax arbitrage that some traders used when placing cash to work. (The one exception stays for hybrid funds that put money into each debt and fairness.) Bhavin Jatania, head of merchandise at 360 ONE (previously IIFL Wealth), says: “We’re simply seeing the beginning of this pattern. On account of a change in rules, lots of people over-allocated to debt in February and March.” He expects the rise in investments to proceed.

With solely 2 p.c of demat accounts having some type of debt securities, in line with knowledge from Central Depository Providers, there’s loads of room for traders to allocate bigger quantities to debt. “Within the final 12 months, individuals have shifted their investments on account of (uncertainty) within the fairness markets. They usually need to faucet into rising charges,” says Mahavir Lunawat, founding father of Pantomath Monetary Providers.

For now, there are 3 ways through which traders could make allocations. There’s the tried-and-tested mutual fund route. There are Do-It-Your self bond funding platforms like Indiabonds.com and Zerodha-backed GoldenPi. And there are AIFs—Class 2 funds cater to debt investments and unlisted fairness, and most large-ticket debt investing is anticipated to occur right here.

Additionally learn: Which shares did Radhakishan Damani, India’s richest investor, guess on in Q1

The Rise of AIFs

Marketed to stylish traders who can make investments a minimal Rs1 crore, AIFs supply a wide range of debt decisions. “Traders are asking whether or not personal credit score markets can supply the identical return as public markets,” says Karthik Athreya, head, product and technique personal credit score at Sundaram Alternates. What AIFs do is figure in direction of getting these increased returns by benefiting from a wide selection of investments obtainable within the debt area. In accordance with knowledge from the Securities and Change Board of India, Class 2 funds have additionally seen the very best progress during the last decade. Within the 12 months ending June 2022, 93 Class 2 AIFs have been launched in comparison with 30 Class 1 and 14 Class 3 funds.

These funds have taken benefit of the truth that submit 2010, the banks have more and more moved to lending to bigger firms in addition to for working capital necessities. This leaves a big swathe of firms with revenues between Rs100 crore and Rs2,000 crore seeking credit score. “We imagine this chance to be Rs50,000 crore in annual demand,” says Athreya of Sundaram Alternates. “A bunch of eventualities—acquisitions, company reorganisations, last-mile working capital mismatches, refinancing, bridge to liquidity occasions like IPOs usually don’t fall inside financial institution credit score appraisal programs.”

As well as, there are misery conditions like when a enterprise goes by way of insolvency proceedings the place banks might not lend to or enterprise debt. A overwhelming majority of debt cash is being raised in these areas. In accordance with estimates, $50 billion (Rs400,000 crore) is already invested in Class 2 AIFs and this market is rising by 25 to 30 p.c a 12 months.

Now, consequently to adjustments in tax legal guidelines, the AIF construction has grow to be extra engaging to HNIs for 2 causes. One, the tax price is similar. And second, as a consequence of this, AIFs could make their investments extra broad primarily based.

That is the way it performs out. Earlier AIFs wouldn’t need to put money into authorities bonds as submit tax, they might be no higher off than mutual funds. (AIFs have been taxed on the slab price whereas mutual fund traders had the advantage of indexation, which in impact lowered the tax to about 15 p.c.) In consequence, AIFs would solely purchase bonds that yielded in extra of 10 p.c. “Now your entire area from 8 p.c to twenty p.c yielding devices is open to us,” says Jatania of 360 ONE. That brings in additional flexibility and makes traders extra keen to place within the increased ticket sizes that AIFs require. Because the fairness threat premium declines, anticipate extra Class 2 AIF launches this 12 months as traders search increased returns with much less volatility.

Additionally learn: Demats dip, SIP achieve

Do-It-Your self Debt Platforms

For the typical investor, bond platforms supply the perfect path. Over the past 12 months, the Reserve Financial institution of India (RBI) has tried to deepen investing avenues for bonds. The launch of the RBI direct scheme is one such avenue. Residents can go and purchase RBI bonds immediately.

Others who anticipated the next price of return than fastened deposits had prior to now discovered alternatives shut out to them. “Beforehand excessive yield bonds have been accessible solely to HNIs and establishments,” says Vijay Kuppa, CEO at InCred Cash. At finest they may undergo the mutual fund route. However shopping for bonds of state governments, state firms, non-banking finance firms have been alternatives.

Particular person traders nonetheless wanted a platform to view quotes in addition to to be made conscious that there are alternatives that give increased returns than fastened deposits. Over the past 5 years, choices like GoldenPi, Indiabonds.com and InCred supply bond quotes to traders. Goenka of Indiabonds.com says, “The 2 greatest issues have been the lack of information and the technological entry to make investments simple.” Whereas KYC is rather a lot simpler now—bonds get credited on to the demat account—the attention bit is an ongoing course of.

Suku Thomas Samuel, 37, who began investing in bonds submit Covid, got here to GoldenPi as he needed the next return than fastened deposits. He invests largely in non-convertible debentures that yield 9 p.c and above. Through the years, he has moved 10 p.c of his investments to bonds. He finds the platform clear and as he is ready to analysis himself, he’s snug with the extra threat that leads to the upper yields. An added benefit is that his investments could be as little as Rs10,000. Abhijit Roy, CEO, GoldenPi, says: “Folks below 30 normally go for increased yields, of say 9 p.c. It’s these above 40 who go for extra secure yields and make investments increased quantities,” he says. GoldenPi has Rs6,000 crore value of bonds listed on any given day.

One side that traders pay much less heed to is the liquidity threat with bonds. With a mutual fund, they may have the ability to redeem at a time of their selecting, however a bond has to discover a purchaser. Right here platforms say they may assist the holder search for consumers, however that is accomplished on a best-effort foundation. Particular person traders Forbes India spoke to say they hadn’t had a chance to promote their bonds earlier than expiry.

So whereas a big a part of the promise of debt investing is fastened returns with low volatility, it’s also true that rising rates of interest globally is what has spurred curiosity on this asset class. A decline in world rates of interest may hamper progress as traders as soon as once more tilt in direction of fairness to generate increased returns. How inflows rise in a falling price surroundings shall be key to trace.

<!–

Click on right here to see Forbes India’s complete protection on the Covid-19 state of affairs and its influence on life, enterprise and the financial system

–>

<!–

Try our Monsoon reductions on subscriptions, upto 50% off the web site value, free digital entry with print. Use coupon code : MON2022P for print and MON2022D for digital. Click on right here for particulars.

–>

Try our Festive affords upto Rs.1000/- off web site costs on subscriptions + Present card value Rs 500/- from Eatbetterco.com. Click on right here to know extra.

<!–

Try our 75th Independence 12 months reductions on subscriptions, extra Rs.750/- off web site costs. Use coupon code INDIA75 at checkout. Click on right here for particulars.

–>

Adblock take a look at (Why?)