The European Union, set to develop into one of many largest issuers of inexperienced and sustainable bonds, will promote debt for the primary time in 2021 off the again of record-breaking demand final yr.

The bloc will doubtless subject 14 billion euros ($17 billion) of seven-year and 30-year social bonds for a job assist program within the coming week. That’s only a taster for traders for the primary provide as soon as it begins funding a landmark pandemic restoration program in the midst of this yr.

By the point of completion, the EU can have bought round 800 billion euros of bonds — a 3rd of which will probably be inexperienced — placing it firmly within the ranks of the world’s largest issuers. If current euro-area offers are something to go by, the EU’s choices ought to be a hit, and will even cannibalize demand for debt from member states.

France racked up document orders for a 50-year debt sale this month, whereas Italy’s 10-year syndication noticed demand simply shy of its all-time excessive. Final yr the EU obtained the most important orderbook ever, garnering 233 billion euros of bids for a two-part social bond deal in October.

“Demand is unlikely to match the numbers seen within the first points, however ought to be ample,” stated Jan von Gerich, chief strategist at Nordea Financial institution Abp. “There are many different traders on the market than simply the European Central Financial institution.”

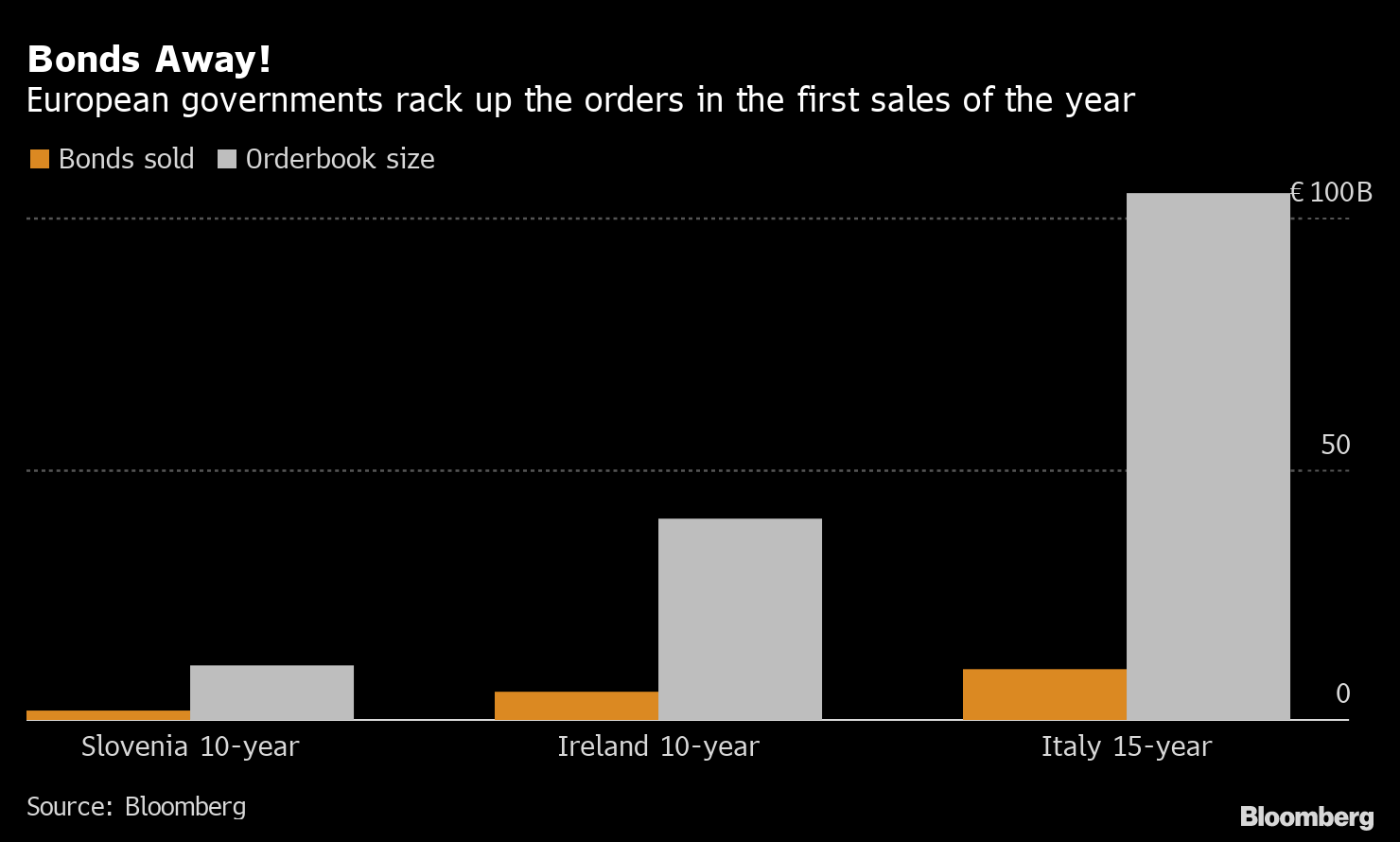

Bonds Away!

European governments rack up the orders within the first gross sales of the yr

Supply: Bloomberg

.chart-js { show: none; }

The sale comes after the ECB on Thursday maintained the scale of its 1.85-trillion-euro pandemic bond-buying program, which has boosted the value of debt throughout the area. That’s left traders grappling with a scarcity of high-quality funding grade securities — one thing the EU with its AAA score is about to supply.

Week Forward

Aside from the EU’s debt issuance, standard authorities bond gross sales are anticipated to sluggish subsequent week, with Commerzbank AG estimating about 16 billion euros will come to market from Germany, Italy and the Netherlands. The U.Okay. will promote 2.5 billion kilos of 2035 bonds and 1.75 billion kilos of 2050 bonds on Tuesday, adopted by a sale of inflation-linked bonds Wednesday.

The Federal Reserve’s first interest-rate resolution of the yr Wednesday marks the main occasion of the week, with bets constructing in markets that the establishment may very well be an early mover amongst main central banks to start tapering its asset-purchase program. In Europe, the main focus will even be on the tempo of the ECB’s purchases, with Italian politics nonetheless uneven amid continued hypothesis of recent elections within the nation.

- Portugal has an election with President Marcelo Rebelo de Sousa main two surveys of voters’ intentions; volatility within the nation’s bond markets is predicted to be restricted

- World Financial Discussion board additionally takes place

- Cash market merchants will deal with ICE’s session spherical on discontinuing Libor closing Monday

- Germany kicks off euro-area knowledge with its IFO launch Monday, whereas CPI knowledge from Saxony and Brandenburg Thursday presage the figures for the broader euro space the next week

- No top-tier knowledge for the U.Okay. scheduled

- Busy week for ECB audio system, with President Lagarde talking Monday, and Panetta, Lane, Elderson, Weidmann, Centeno, Villeroy and Schnabel all making appearences

- BOE Governor Bailey speaks at World Financial Discussion board 5pm Monday

Let’s block adverts! (Why?)