IT shares

Infy: Rs 1.5 crore (1995*)

Infosys is the stuff of center class desires. It was based as an IT providers firm in 1981 by seven engineers led by N R Narayana Murthy, with an preliminary capital of Rs 10,000 that Murthy’s spouse gave him. It was cash she had saved for a wet day. The identical 12 months it signed its first software program shopper, New York-based Knowledge Fundamentals Company.

In 1987, it opened its first worldwide workplace in Boston. Six years later, it launched an worker inventory choices programme and the identical 12 months, it did a really profitable IPO. In 1999, it turned the primary India-registered firm to listing on the Nasdaq. As India’s IT revolution took off, and Infy’s share value surged, the broadly distributed share construction created quite a few greenback millionaires.

TCS: Rs 2.7 lakh (2004)

Tata Consultancy Providers launched as a division of Tata Sons on April 1, 1968, as a administration and know-how consultancy that may create demand for downstream laptop providers. F C Kohli, a superb technocrat, was introduced in from Tata Electrical Cos to run it. Because the govt mandated that any import of computer systems should entail exports of twice the worth, TCS developed an exterior market focus.

It began constructing software program for frequent processes like monetary accounting. In 1973, a partnership with American enterprise gear maker Burroughs resulted within the first recorded occasion of an offshore software program supply finished out of India, achieved utilizing automation. These efforts resulted in TCS main India’s software program revolution.

Wipro: Rs 36 lakh (1995*)

Wipro was based in 1945 in Amalner, Maharashtra, by Mohamed Premji to fabricate vegetable oil. It did an IPO the 12 months after and was listed on the BSE. Mohamed died in 1966, forcing his son Azim to desert his research and take over the corporate. In three a long time, Premji took Wipro first into computing {hardware}, after which into IT providers.

It was listed on the NYSE in 2000. India’s IT revolution resulted in Wipro’s income and share value surging. Premji’s possession of 75% of the inventory made him one of many richest Indians. The financial advantages of most of these shares are dedicated to his philanthropic foundations.

Fairness tradition

RIL: Rs 39.5 lakh (1992*)

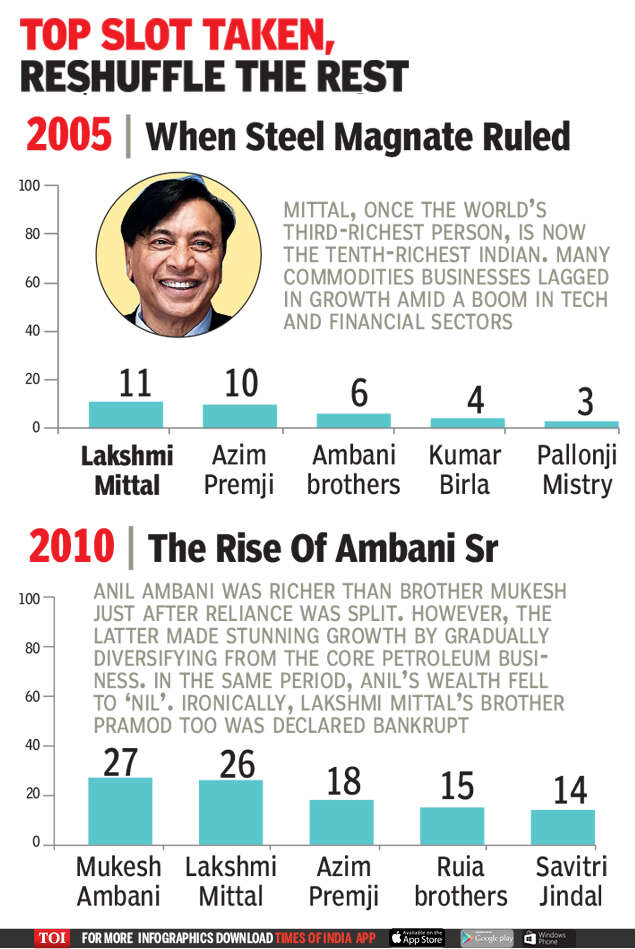

Began in 1966 as a small textile producer, RIL has morphed into an enterprise with pursuits in petrochemicals, oil & gasoline, retail, telecom and monetary providers. Its IPO in 1978 launched the fairness tradition in India and its market worth then was Rs 10 crore.

As we speak, RIL enjoys a market cap of Rs 13.3 lakh crore. After founder Dhirubhai Ambani’s demise in 2002, the empire was divided between his two sons, with the older Mukesh inheriting the flagship, and Anil getting the new-age biz like telecom. In 2016, RIL disrupted India’s cellular providers sector with the launch of Jio.

Others

Titan: Rs 42 lakh (1992*)

Began as a watchmaker in 1984, Titan is a JV between the Tatas and the Tamil Nadu Industrial Improvement Corp. It listed in 1987 and, in 1993, it entered jewelry — now its greatest income contributor. Titan additionally acquired into perfumes & eyewear. It has emerged because the second greatest jewel within the Tata Group’s crown with a Rs 1.4-lakh-crore mcap after TCS.

Asian Paints: Rs 43 lakh (1992*)

Based by 4 associates within the pre-independence period, Asian Paints is a sector chief. It expanded into associated areas within the residence enchancment area from furnishings to lightings. It additionally launched hand sanitisers and floor disinfectants. RIL holds about 5% stake in Asian Paints, purchased in 2008, months earlier than the collapse of Lehman Brothers.

Crisil: Rs 11 lakh (1994)

An S&P arm, the homegrown score company has remodeled into a worldwide analytics co, producing extra income from exterior the nation than from inside. The assist from a dad or mum, which has a big stake, and Rakesh Jhunjhunwala holding one other huge chunk has helped the inventory.

Financials

HDFC Financial institution: Rs 37 lakh (1995)

What units it aside from different performers is the consistency with which it has delivered. It has generated a 20% revenue progress over time, no matter market situations. The financial institution, which began out by cherry-picking company wage accounts for retail deposits, is now a pan-India establishment that has cracked the power to ship small loans profitably and gained international recognition. Regardless of its scale, it’s on the reducing fringe of innovation and offers fintechs a run for his or her cash with its digital technique.

HDFC: Rs 20 lakh (1993)

HDFC is synonymous with residence loans. What makes it a star performer is that regardless of competitors from banks, it is ready to preserve its scale of operations with out diluting its mortgage high quality. The strict underwriting and a sensible strategy to loans has resulted within the firm having the bottom degree of dangerous loans amongst all lenders together with banks.

What many don’t realise is that in addition to being a housing finance firm, HDFC is an funding co holding giant chunks of priceless companies like banking, life & non-life insurance coverage and stockbroking.

Bajaj Finance: Rs 30 lakh (1994)

When Rahul Bajaj break up his enterprise between his sons Rajiv and Sanjiv, it regarded just like the youthful Sanjiv Bajaj was getting an offshoot of the principle household enterprise. No company had cracked monetary providers. However this was one uncommon occasion the place the division of enterprise led to the multiplication of wealth.

Bajaj recognized that there have been producers and retailers keen to associate lenders who finance the acquisition of their merchandise. Additionally, know-how was obtainable to ship small loans after underwriting prospects. The consequence — an organization that’s valued at over Rs 3 lakh crore, greater than SBI’s Rs 2.6 lakh crore.

Bajaj Finserv: Rs 2 lakh (2008)

Whereas its twin Bajaj Finance will get many of the loans and the market valuation, Bajaj Finserv has the benefit of being a holding firm, which owns two extraordinarily priceless insurance coverage companies. Unknown to most, Bajaj’s insurance coverage joint ventures are probably the most worthwhile personal insurance coverage corporations.

Though twenty years in the past, Bajaj had contracted to promote a majority stake to international associate Allianz if legal guidelines allowed it, nevertheless, the absence of liberalisation enabled Bajaj to retain a majority within the insurance coverage corporations, which proceed to thrive as a part of Bajaj Finserv group.

Pharma

Dr Reddy’s: Rs 2.2 crore (1991)

Dr Reddy’s Laboratories, listed right here in 1991, is likely one of the first drug corporations to be listed on the NYSE. It was arrange in 1984 by (late) Ok Anji Reddy and his associates.

Dr Reddy’s has a diversified manufacturing footprint unfold throughout India, the US, the UK, China and Mexico, and is taken into account a proxy for international traders.

Divi’s Labs: Rs 47 lakh (2003)

Based by Murali Divi in 1990 after a break up from Dr Reddy’s, it’s been on an uptick attributable to constant and robust efficiency. Divi’s is likely one of the largest generic API producers globally, and a longtime participant within the highly-lucrative CDMO enterprise (contract growth and manufacturing organisation) with a robust relationship with six of the highest 10 Large Pharma.

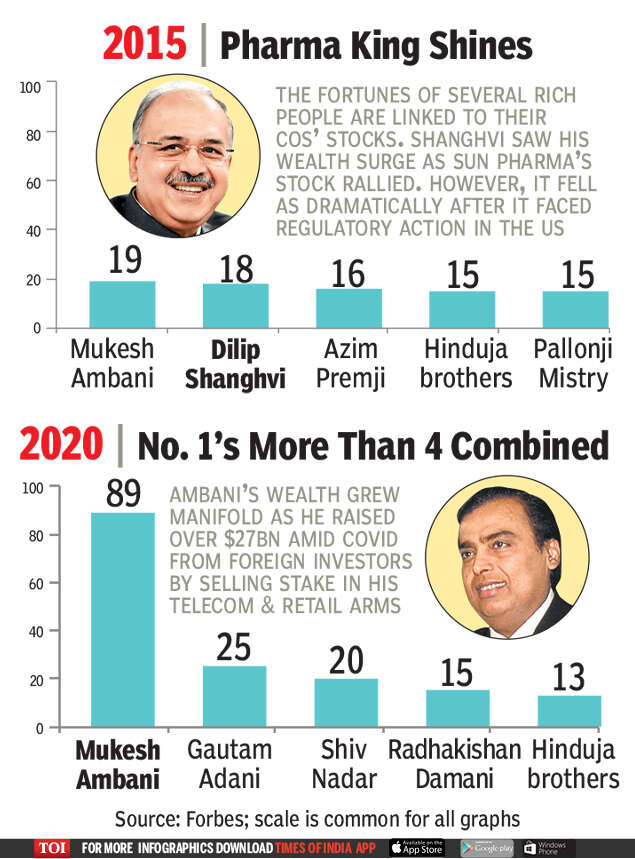

Solar Pharma: Rs 31 lakh (1994)

It was began by Dilip Shanghvi in 1983 with a capital of few thousand rupees. Listed in 1994, it’s now the world’s fourth-largest generics participant. It has had a gentle streak upwards, underpinned by profitable acquisitions like Taro, a robust, diversified portfolio in India, which provides it a commanding share of over 8%. The corporate’s choices of branded generics and specialty generics within the US, present an edge, fetching vital margins.

(* Denotes earliest obtainable mcap date, as itemizing value information was unavailable)

(Textual content by Shilpa Phadnis, Mayur Shetty, Reeba Zachariah & Rupali Mukherjee)